Investing in property through a Self-Managed Superannuation Fund (SMSF) is a powerful way to grow your retirement savings while building a portfolio. But what if your SMSF investment property could pay itself off entirely in just 13 years? Here’s how Liviti can help you achieve this with a strategically chosen property, ticking all the right boxes for smart investors.

What Is an SMSF?

A Self-Managed Superannuation Fund (SMSF) is a private super fund that you manage yourself. Unlike traditional superannuation funds, an SMSF gives you full control over where your retirement savings are invested, including the ability to purchase property. This flexibility can help you build wealth in a way that aligns with your goals, but it also requires compliance with strict rules set by the Australian Taxation Office (ATO).

Key features of SMSFs:

- Control: You decide how your super is invested, whether in shares, property, or other assets.

- Compliance: Investments must comply with ATO regulations, including the sole purpose test (benefiting your retirement savings).

- SMSF Loans: Borrowing to invest in property is possible through a limited recourse borrowing arrangement (LRBA).

Why an SMSF Investment Property Is a Smart Choice

An SMSF provides greater control over your retirement savings and allows for diversification into assets like property. One of its biggest advantages is the ability to borrow within the fund, making it an ideal strategy for investors who are stuck after reaching their personal borrowing limit. If you’re at your borrowing capacity and looking to expand your portfolio, an SMSF can be the key to acquiring a third, fourth, or even additional properties without affecting your personal finances.

Investing in property through an SMSF allows you to leverage your super contributions to secure a tangible, income-generating asset. With the right property, you can enjoy positive cash flow, long-term capital growth, and tax benefits, making it the most efficient way to continue growing your portfolio and ensuring a secure financial future.

An SMSF Investment Property Opportunity at a Glance

How would you like a property that’s:

- Eligibility for SMSF investment, ensuring compliance with superannuation laws.

- A prime location, just 17km from Sydney’s CBD.

- Affordability, with a purchase price under $600,000.

- Positive cash flow, generating consistent income.

- A secure tenancy, as it’s already tenanted.

- A rental guarantee of 6% yield, providing peace of mind.

- The potential to be fully paid off within 13 years, leaving you with a debt-free asset.

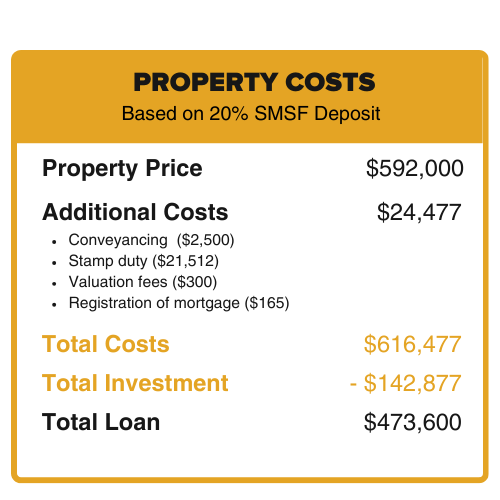

The Financial Breakdown of a SMSF Investment Property

Here’s a real life example of our investment properties work to pay themselves off:

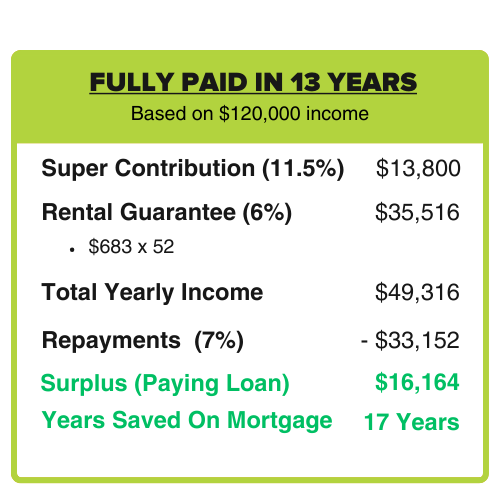

How It Works

This combination of rental income and superannuation contributions creates a powerful strategy to fast-track your mortgage repayments. By applying the surplus cash flow towards the loan principal, the property is completely paid off in just 13 years, leaving you with a fully-owned asset generating consistent passive income for your retirement.

Why This SMSF Investment Property Makes Sense

- Leverage Your Super: Instead of relying solely on traditional super investments, this property allows you to diversify into real estate.

- Positive Cash Flow: The rental income exceeds the mortgage repayments, providing a surplus that accelerates your loan payoff.

- Long-Term Value: With a property located close to Sydney’s CBD, you can expect strong capital growth over time.

- Security: A rental guarantee and an already tenanted property ensure steady income from day one.

- Affordability: With a purchase price under $600,000, this is an accessible entry point for SMSF investors.

Is This Strategy Right for You?

Investing in property through an SMSF requires careful planning and adherence to regulations. At Liviti, our experts can help you determine if this opportunity aligns with your financial goals and retirement strategy.

Learn more about managing an SMSF investment property effectively

Ready to Get Started?

Contact Liviti today to learn more about how a SMSF investment property can help you secure your future. Book a free discovery call with our team to explore your options.