If you are thinking about buying a property, you might be wondering: What makes a better investment ‒ an apartment or a house? Choosing the type of property to buy is not an easy decision, especially for first home buyers or property investors. This decision can be influenced by your financial situation, lifestyle, and sometimes your property goals.

To decide between an apartment or a house you first need to know why you’re buying a property in the first place. Is it an investment? Are you trying to maximise your capital return or you are trying to bring in as much rent as possible? If you’re buying a home, will an apartment suit your lifestyle needs better than a big house with a backyard to maintain? And your financial position affects your choice as well.

Whilst the decision might overwhelm you at the beginning, continue reading to find out everything you need to know to make the process easier and to make a well-informed decision. Whatever you choose, we’ve outlined the pros and cons you need to consider for both houses and apartments. After all, only you can make the best decision for yourself!

What’s the difference between apartment and house?

What is an Apartment?

An apartment is a residential unit that is part of a residential building. In general, apartments are generally smaller than houses and share common areas like car parking, courtyards and other amenities.

There is usually one owner’s corporation or external management company for all the units that do all the maintenance and upkeep.

What is a House?

A house, on the other hand, is an independent property that can be multi-storey with a front and backyard. The owners own the land on which the house resides.

In terms of size, houses tend to be larger but varies hugely depending on the land size. There can be different house types including townhouse, terrace, semi, duplex and villa.

Key things you should consider before purchasing your first home

Deciding on which type of property should you purchase isn’t always an easy decision. There are quite a few factors to consider which can include your future intent of whether you want to live in or rent out the property as an investment.

Here, we list out some key factors to consider when you are looking for a property.

#1 Affordability

Since apartments are often smaller than houses, they are usually less expensive. According to CoreLogic, at the end of 2021, the average Sydney house was currently selling for $1.36 million, with apartments selling for an average of $837,000. The median house and unit valuation difference is currently close to $500,000.

So, to have a 20% deposit for a house in Sydney, you’d need around $272,000, while for an apartment building deposit, you’d need $167,400 – that’s more than $100,000 less!

This massive difference in price makes apartments a more affordable entry point into the market for homebuyers, especially in a good location.

Over the last two years, the price difference between a house and an apartment has grown tremendously due to the Covid-19 pandemic. Many people were looking for a bigger living space in their homes, due to the extensive lockdowns across the country. However, As lockdowns are becoming a thing of the past, apartments are making their way back on the market, trendier than ever.

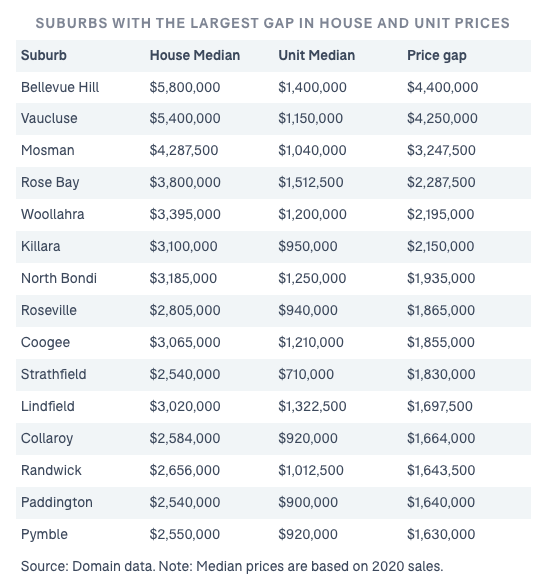

The general price difference between houses and apartments across various Sydney suburbs is shown in the table below.

#2 Location & Community

Location. Location. Location!

This factor is often the single most important driving force behind the value of a property. An average house in a great location will often outperform a great house in an average location.

A good location can mean different things to different people. But normally, when it comes to what makes a location great, homebuyers tend to look for a centralised location within close proximity to work, public transport, school catchments and other lifestyle amenities such as beaches, popular cafes, restaurants, shopping centres, and parks.

A truly great neighbourhood with a good appearance, friendly people and a feeling of safety is also the type of place that most people want to live.

A tip to search for a good location is you should look for areas where demand is high and the number of properties coming onto the market is limited, as this will mean that the location you are looking at tend to be more desirable than others.

However, it’s often a question of location and budget when you are choosing between property types. While affordable apartments are often concentrated in the key suburbs with good connections, houses within the first-home buyer budget are normally located in the outer suburbs.

So, in most cases, if you can afford an apartment in a better location than a house, it’s definitely worth considering.

#3 Maintenance & Ongoing costs

House owners are accompanied with additional responsibilities such as maintaining the building, lawns on the block, and so on. Even if you have someone take care of it for you, you still have to pay a hefty fee to get the work done. Houses also come with higher council rates and insurance, as well as higher utility bills as they cost more to heat and cool.

On the other hand, apartment buildings can make a perfect match for those with a super busy schedule because the property managers will have the responsibility to maintain not only the common areas but also any amenities & maintenance that comes with them.

However, you are sharing the ownership of common property as well with the developer and other lot owners, including shared facilities such as elevators, stairs, pools or gyms. And this will be calculated under a strata scheme by an owners corporation.

#4 Land and development

It is not just the present amenities that matter, but future ones as well.

The key benefit of owning a house is in reality the land upon which the house has been built. This is because land appreciates in value as the population increases and it makes a splendid investment in the long term. On the other hand, buildings depreciate through wear and tear and need to be constantly maintained.

In addition, houses have greater potential because renovations, extensions or a rebuild can enhance the face value of the property. Apartment owners share in the land their complex occupies, and it doesn’t leave much liberty to extend or rebuild but you can renovate cosmetically.

So far, both apartments and houses are emerging victorious but keep evaluating these two in accordance with your needs and wants and the choice would become clearer as you keep reading.

Questions to ask yourself before you buy a property

Out of a million questions that must be running through your head, let’s pick a few that would actually help you in reaching a final decision.

The following questions will help you determine which factors are important for yourself and help you decide on where to live :

What can you afford?

- What is your budget?

- How much can you borrow?

- Are you eligible for government grants and benefits?

- Are you aware of the upfront fees that you will need to pay?

Location & Community

- Do you want to live close to the beach or close to the city?

- Is the location well-connected by roadway or train networks?

- Is the location in close proximity to good schools and colleges?

- Are amenities such as playgrounds and recreational parks easily accessible?

- Is there an NBN network in the area?

- Are there a good shopping centre or market in that location?

Features & Facilities

- How big is your family?

- Is a garage essential?

- Do you want a backyard?

- Do you have pets?

- Do you want facilities like a pool or gym?

- Do you want to do renovations?

- What are you or aren’t you prepared to compromise on?

Future Proof

- Will you need to upsize or downsize in the future?

- Will you be an owner-occupier forever? Or will you rent out the property at some point?

- If so, will renters find the property appealing?

The house versus apartment dilemma depends on your lifestyle, finances and property goals

After learning everything about houses and apartments, this dilemma boils down to one thing, your priorities. Making a list of your realistic goals and where you see yourself in the future can help immensely. Set goals according to your lifestyle and work towards saving up on the deposit and other hidden costs when buying a property. A little bit of planning can go a long way and in no time you would be cherishing your dream home.

Do apartments or houses make for better investments?

Usually, houses have better capital gain than apartments because as mentioned above, the land they sit on tends to appreciate in value over time, whereas apartments generally have a much lower portion of land (if any at all), so they won’t rise in value as quickly as houses do.

#1 Higher Rental income

Rental yield is the profit you make on your investment property each year as a percentage of its value. A high rental yield usually equates to more cash flow, which means you can live off of that passive income if renting it out as an investment property.

Generally speaking, apartments earn significantly higher rental returns than houses, especially in the inner suburbs with good proximity to public transport and amenities. This is also true in “university suburbs”, where the demand for a rental property is often higher as a result of more international students.

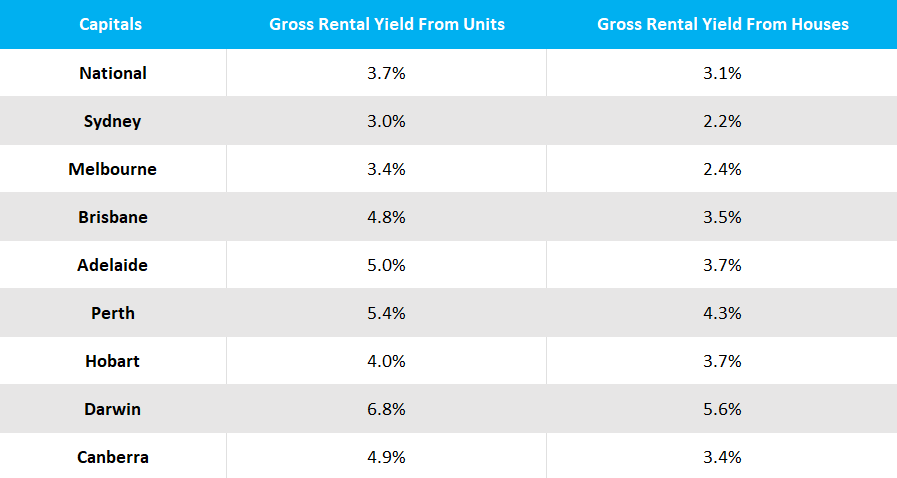

CoreLogic Home Value Index released on January 2022 shows the gross national rental yield from apartments is 0.6% more than that from houses.

Source: CoreLogic Hedonic Home Value Index, January 2022

Offering an affordable entry point into the market, investing in an apartment means less costs, fewer risks and more investment choices while generating a maximum rental income.

#2 Steadier Capital Growth

Capital growth refers to how the property appreciates in value over time and it is also a key way investors build wealth, so it’s crucial in all investment properties.

Houses, as opposed to apartments, offer greater long-term capital growth than apartments because land often appreciates over time and houses typically have more associated land than apartments.

However, looking at the current trend in the property market, the median price for a house in Sydney hits a record $1.36 million and Corelogic data indicates Sydney’s house market may peak in 2022.

Units, on the other hand, experienced a much more steady growth of 8.3% over the year 2021, and are expected to grow at a much faster rate this year due to the coming back of international students and migrants.

So even though houses tend to offer greater capital growth than apartments, this isn’t always the case when you take into consideration factors such as market trend or location.

#3 Further Discounts and Benefits

Other than your deposit, there will be a list of other upfront costs you might need to consider when buying a property. This can include stamp duty, plus legal and conveyancing fees.

If you are looking to purchase a house, you will be looking at paying more on these upfront costs as houses tend to be more expensive. On the other hand, for most apartments, especially off-the-plan purchases, you may pay a lot less.

Choosing an apartment over a house will also save even more for first home buyers due to the extensive government stamp duty exemptions and concessions.

As part of the First Home Buyers Assistance Scheme from 1 August 2021, NSW first home buyers purchasing newly built, off-the-plan properties, established properties or vacant land continue to get a complete exemption under the following circumstances:

- New homes valued up to $650,000 (concessions available between $650,000-800,000)

- Established property valued up to $650,000 (concessions available between $650,000-800,000)

- Vacant land worth up to $350,000

Given apartments are generally cheaper, they’re more likely to fall under these thresholds and therefore save buyers anywhere up to nearly $25,000 in stamp duty.

#4 Off The Plan Apartment

One benefit of purchasing an apartment is that you can always buy off the plan – which means buying in an apartment building that hasn’t yet been completed.

Some benefits of buying off the plan might include:

- Only pay your deposit upfront, with the balance not due until the property has been completed.

- Stamp duty discount or exemption.

- Secure a property at today’s prices.

- Make a capital gain before you even move in!

Buying an apartment vs a house

After considering multiple aspects that determine whether you should go for a house or an apartment, you must have been getting a better idea of where your inclination lies. To get your thoughts organised (considering the abundance of information), We have put down the major pros and cons of each.

Pros of Apartments

Apart from a stunning view or alfresco balcony, what are the pros of buying an apartment?

- More affordable options: Apartments offers an affordable entry point into the market, in an area that may beyond your budget if you were looking at stand-alone houses.

- Less maintenance costs: the owner corporation/property managers repair and maintain the common areas.

- Security: new apartments tend to have swipe cards and CCTV, and having more people around is generally a plus.

- Amenities: units can come with added extras such as gyms, pools, lifts and tennis courts.

- Lower bills: living in a unit will cost you less when it comes to water, heating and gas.

- Higher rental yields: Apartments tend to have higher rental yields than houses.

Cons of Apartments

- Less space: flats are usually smaller than houses

- Privacy and noise: proximity to neighbours can sometimes be an issue for apartment dwellers, though all off the plan apartments are acoustically treated to comply with the Building Code of Australia.

- Body corporate fees (Strata fees): these can be cheaper in older apartments with no amenities but can become quite expensive if your complex has lots of onsite amenities to maintain.

- Reduced flexibility: The council and building regulations stipulate whether you can have pets, allowable noise levels, and whether you can renovate.

- Fewer parking spaces: there is increased competition for car spaces around high-rises and an individual space on your title can be costly.

Pros of Houses

- More space: houses have minimum block sizes set by the government and the dwellings tend to be larger than a unit or townhouse.

- Outdoor space: most houses come with a front or back garden, or both.

- Privacy: houses offer greater privacy, as you are not sharing common areas with multiple people.

- Flexibility: a shared title often brings rules, especially when it comes to renovations. You are free to do what you like, permitting council regulations.

- Resale value: in general, houses appreciate faster than apartments.

- Capital Growth: Houses have a higher capital growth than apartments

Cons of Houses

- Deposit and stamp duty: Houses generally have a higher purchase price, meaning a higher deposit and stamp duty.

- Expensive: houses tend to be more expensive than other types of property in the same area.

- Maintenance: keeping a house in good nick is a lot of work. There is cleaning, gardening, plumbing and a whole range of other tasks – not to mention ongoing repairs as opposed to apartment living where everything is maintained by your property managemers or owners corporation.

- Bigger bills: houses are generally harder to heat and cool, which means larger utility bills. You must also take out insurance by yourself, which means bigger premiums.

House vs apartment: making your decision

Congratulations! You have made it to the end of the article and your dilemma of whether you should go for a house or apartment (we hope)!

At the end of the day, it all comes down to the kind of lifestyle you engage in and your priorities when you are looking for a home or investment property.

Be it apartments or houses, what matters is that you find yourself at home. It might seem like a complex procedure but if you plan ahead, you will be looking back at this time with a key to your home in your hand!

In case you still have questions regarding these problems, contact Liviti today at (02) 9056 4311 or get in touch with us here to have our experienced consultants help you out with all your enquiries from top to bottom.

Liviti is here to cater to your wants and needs with years of experience backing your journey.