The Australian rental market has experienced significant fluctuations in recent years, influenced by various economic, social, and policy changes. Understanding these trends and projections is crucial for investors, renters, and policymakers alike.

After reading this comprehensive guide, you’ll get an in-depth insight into the state of the Australian rental market, focusing on key cities and data-driven insights to forecast future developments.

Key Takeaways

- Overview of the Australian rental market, highlighting key trends and projections for 2024.

- Detailed insights into the rental markets of major cities: Sydney, Melbourne, Brisbane, and the Gold Coast.

- Analysis of rental market data and the factors influencing rental prices and demand.

- FAQs addressing common questions about the Australian rental market.

Overview of the Australian Residential Rental Market

The Australian rental market has shown resilience amidst global economic uncertainties. With a mix of high demand in metropolitan areas and varying rental yields across different regions, the market presents both challenges and opportunities.

National Trends

- Rental Demand: Increasing urbanisation and population growth have driven rental demand in major cities.

- Rental Prices: Prices have seen significant growth, especially in Sydney and Melbourne, due to limited supply and high demand.

- Vacancy Rates: Low vacancy rates in popular cities indicate strong rental demand and competitive markets.

Sydney Rental Market

Sydney, Australia’s largest city, continues to be a focal point of the rental market due to its economic opportunities and lifestyle appeal.

Current State

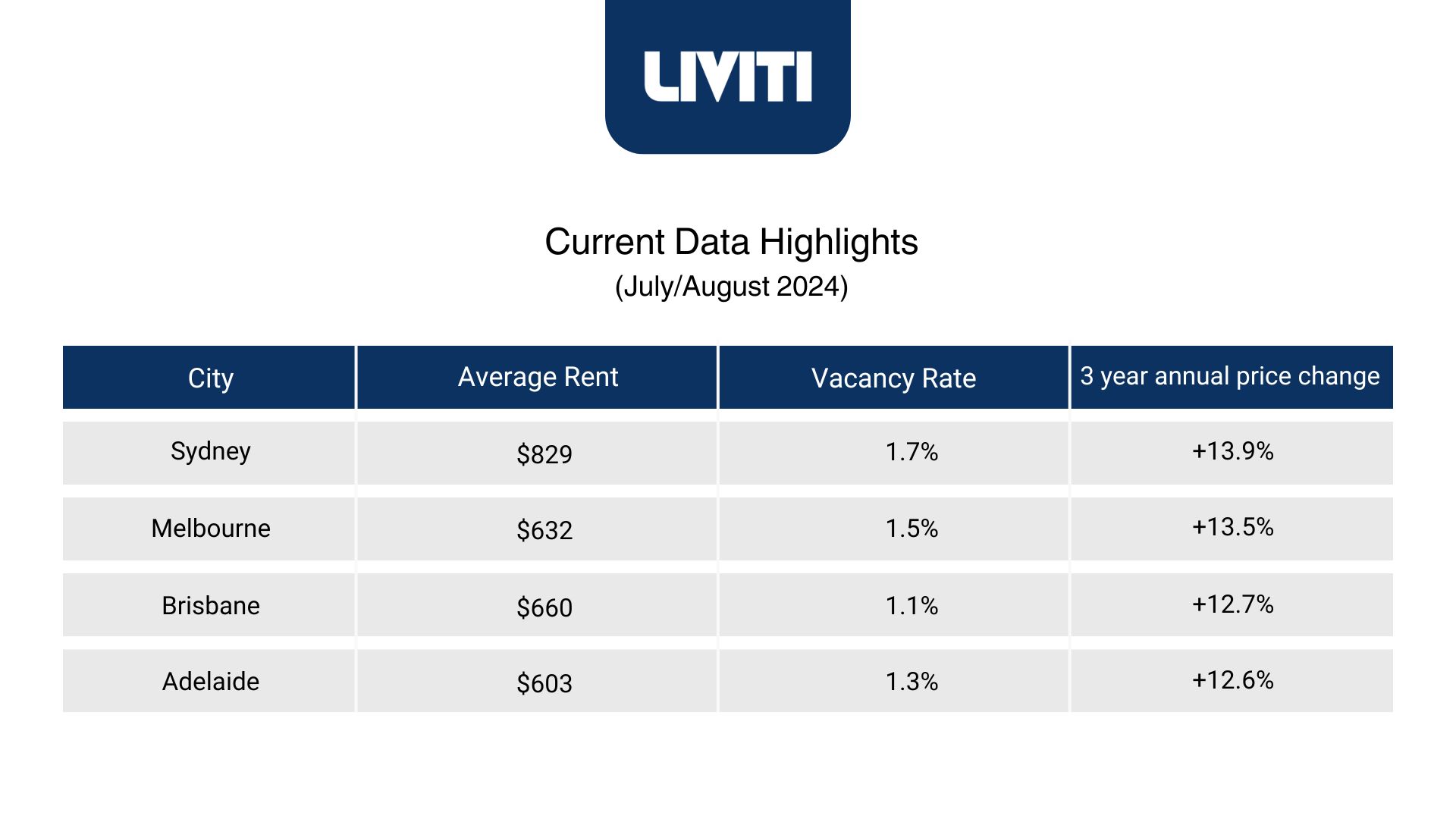

- Rental Prices: Sydney’s rental prices are among the highest in the country, increasing 13.9% annually over the past three years. Reaching a combined average across property types of $829 per week. (SQM, August 2024)

- Demand and Supply: High demand from both local and international renters, coupled with limited new housing developments, has kept the market competitive with vacancy rate sitting at 1.7%.

Projections

- Price Trends: Rental prices are expected to rise further, driven by ongoing demand and limited housing supply.

- Development Plans: Upcoming housing projects may ease some pressure but are unlikely to meet the full demand.

Melbourne Rental Market

Melbourne is known for its vibrant culture and strong economic prospects, making it a desirable location for renters.

Current State

- Rental Prices: After a temporary dip during the pandemic, rental prices in Melbourne are rebounding strongly. Up 13.5% annually over the last 3 years, reaching a combined average of $632 a week (SQM, August 2024).

- Vacancy Rates: Vacancy rates compared to Sydney have steadied at 1.5%, but still showing of a tight market. (SQM, July 2024)

Projections

- Economic Recovery: As the city continues to recover from pandemic impacts, rental demand is expected to increase.

- Market Growth: Rental prices are projected to grow steadily, reflecting the city’s economic revival and population growth.

Brisbane Rental Market

Brisbane offers a more affordable alternative to Sydney and Melbourne, attracting renters looking for a balanced lifestyle and economic opportunities.

Current State

- Rental Prices: More affordable compared to Sydney, but measuring similar to Melbourne, rental prices are rising due to increasing demand. With the rental average reaching $660 a week, up 12.7% annually over the last 3 years. (SQM, August 2024)

- Demand and Supply: Strong demand driven by interstate migration and local population growth has dropped the vacancy rate to 1.1%. (SQM, July 2024)

Projections

- Market Expansion: Expected growth in rental prices as more people move to Brisbane for its affordability and lifestyle.

- Development Initiatives: New housing developments may provide some relief to the tight market conditions.

Adelaide Rental Market

Adelaide, known for its cultural appeal and relaxed lifestyle, has a growing rental market that caters to both locals and newcomers to the city.

Current State

- Rental Prices: Rental prices in Adelaide have been steadily increasing, driven by demand from local renters as well as interstate migration. Weekly rents across property types sitting at $603 a week, up 12.6% annually over the last 3 years. (SQM, August 2024)

- Vacancy Rates: A Low vacancy rate of 0.7% indicates a competitive rental market, making it challenging for renters to find properties.

Projections

- Tourism Influence: As Adelaide continues to attract more residents, particularly from other states, the demand for rental properties is expected to remain high.

- Infrastructure Developments: Ongoing infrastructure projects, such as road upgrades and public transport improvements, could impact rental supply and prices in the future.

Factors Influencing the Australian Rental Market

Several factors influence the dynamics of the Australian rental market, including economic conditions, population trends, and government policies.

Economic Conditions

Economic conditions play a significant role in shaping the rental market. Key factors such as interest rates and employment trends are particularly influential.

Interest Rates

Interest rates, set by the Reserve Bank of Australia (RBA), are a critical factor in the property market. When interest rates are low, borrowing costs decrease, making it easier for investors to finance new property purchases.

This often leads to increased property investment and higher demand for rental properties as investors look to capitalise on favourable financing conditions. Conversely, when interest rates rise, borrowing becomes more expensive, which can reduce the number of new property investments.

This can lead to a tighter rental market as fewer new properties become available, potentially driving up rental prices due to limited supply.

Employment Trends

Employment trends, especially job growth in metropolitan areas, significantly influence rental demand. Cities that experience robust job growth attract more workers, who often need rental accommodations.

For instance, Sydney and Melbourne, with their strong economic bases and diverse job markets, see consistent rental demand due to their employment opportunities. High employment levels can also lead to increased wages, which can boost tenants’ ability to afford higher rents.

Conversely, areas with declining employment opportunities may see decreased rental demand and lower rental prices as people move away in search of better job prospects.

Population Trends

Population trends, including urbanisation and interstate migration, are vital in determining the demand for rental properties across Australia.

Urbanisation

Urbanisation, or the movement of people from rural to urban areas, increases the demand for rental properties in cities. As more people seek the amenities, job opportunities, and lifestyle that cities offer, the demand for urban housing grows.

This trend is particularly evident in major Australian cities like Sydney, Melbourne, and Brisbane. Urban areas need to expand their housing supply to accommodate the growing population, but the lag in new developments can lead to higher rental prices due to the imbalance between supply and demand.

Interstate Migration

Interstate migration, the movement of people between states, also impacts regional rental markets.

For example, during the COVID-19 pandemic, there was a noticeable shift as people moved from densely populated cities to regions offering more space and a perceived better quality of life.

This migration trend has led to increased rental demand and rising rental prices in traditionally less sought-after areas like Queensland’s regional towns. On the other hand, states losing population may experience a decrease in rental demand and lower prices as supply outweighs demand.

Government Policies

Government policies, including housing initiatives and tax incentives, have significant implications for the rental market.

Housing Policies

Government housing policies aimed at boosting housing supply can impact rental availability and prices. For example, initiatives that encourage the development of affordable housing can increase the number of rental properties, helping to meet the demand and stabilise rental prices.

Policies such as zoning changes, new construction grants, and developers’ incentives to build rental properties are designed to address housing shortages and improve affordability.

Conversely, restrictive housing policies can limit new developments, exacerbating housing shortages and driving up rental prices.

Tax Incentives

Tax incentives affecting property investment can also influence rental market dynamics. The Australian government offers various tax benefits to property investors, such as negative gearing and capital gains tax discounts.

Negative gearing allows investors to deduct the costs of owning a rental property, such as mortgage interest and maintenance expenses, from their taxable income. This can make property investment more attractive, increasing the supply of rental properties.

Additionally, capital gains tax discounts on long-term property investments can incentivise investors to hold onto their properties, affecting the turnover rate in the rental market and potentially stabilising rental prices. Changes in these tax policies can significantly impact investor behaviour and, consequently, the rental market.

By understanding these economic, demographic, and policy factors, stakeholders can better navigate the complexities of the Australian rental market and make informed decisions that align with their financial goals.

Australian Rental Market Data

Analysing rental market data provides valuable insights into trends and future projections.

Current Data Highlights

Data Analysis

- Sydney: Highest average rent and low vacancy rate, indicating strong demand.

- Melbourne: Recovering market with steady price increases.

- Brisbane: Attractive due to affordability, with growing demand.

- Gold Coast: Influenced by tourism, with significant price growth.

Future Projections for the Australian Rental Market

Based on current trends and data, several projections can be made about the future of the Australian rental market.

General Trends

- Rental Price Growth: Continued growth in rental prices across major cities.

- Demand Dynamics: Ongoing high demand in metropolitan areas with possible easing in regional markets.

City-Specific Projections

- Sydney: Sustained price growth and low vacancy rates.

- Melbourne: Steady recovery and price increases.

- Brisbane: Increasing demand and rental prices.

- Gold Coast: High demand driven by tourism and lifestyle appeal.

What’s next?

The Australian rental market presents a dynamic landscape influenced by economic conditions, population trends, and government policies. Understanding these factors and analysing rental market data can help investors, renters, and policymakers make informed decisions.

As we look to the future, staying informed about market trends and projections will be crucial for navigating the evolving rental market landscape in Australia.

By understanding these key aspects of the Australian rental market, you can better navigate the complexities and opportunities it presents.

Stay informed and make strategic decisions to maximise your investment potential and achieve your financial goals.