When it comes to off the plan concession offerings, quite a few benefits are available to purchasers who qualify for them, making them an attractive opportunity for all kinds of buyers.

One of the most popular off the plan concession opportunities involves acquiring a stamp duty concession. Generally, these concessions will benefit first homeowners and purchasers who intend on living in the home.

What Is An Off The Plan Transaction?

Buying a property off the plan means you are entering into a contract for property purchase before the construction of the property has commenced or while construction is in progress.

An off the plan transaction could refer to land that is going to be subdivided, an apartment, a townhouse, or a range of other dwelling types. Land, in itself, does not qualify.

Off The Plan Stamp Duty Concessions

Taking advantage of available benefits is a huge incentive for home buyers, especially ones that allow a reduction to the upfront fees required to secure a home.

What Is Stamp Duty?

Also known as transfer duty, this is one of the bigger costs to be accounted for. It is the tax that the Government imposes when you purchase a property at a particular value, or when the ownership is transferred. Unlike land tax, you only pay duty once.

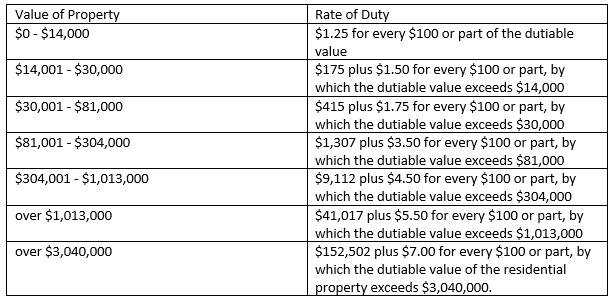

It is calculated according to the total dutiable value of the property.

Simply match up the purchase price of the property you’re considering with the dutiable value information in the table below for NSW rates on owner-occupied or investment purchases. It’s easy enough to find information for other states via Google.

What Off The Plan Concession Is Available With Stamp Duty?

It’s no surprise that Australian stamp duty concession availability and eligibility vary between states.

In NSW, this concession works by pushing the duty payment due date 12 months into the future (ahead of the standard 3-month timeframe), or until the property has been officially handed over, whichever comes first.

In the ACT, if your contract was exchanged between 1 July 2021 and 31 March 2022, no duty applies to off the-plan unit owner-occupier purchases up to $500,000. This was then increased to purchases up to $600,000 as of April 2022.

There are quite a few first home owner concession opportunities including the First Home Buyer Assistance Scheme in NSW which may apply according to the dutiable value of off-the-plan properties.

Honestly, we’re chuffed just thinking of all the smashed Avo on toast those savings could buy!

Who Is Eligible For Off-The-Plan Concessions?

In NSW, in order to be eligible for stamp duty concession, the off-the-plan property you intend to purchase must be a residential property that at least one purchaser intends to live in as a principal place of residence for 6 months continuously, within 12 months of purchasing the home.

You must also be an Australian citizen OR a New Zealand citizen with a subclass 444 visa having lived in Australia for over 200 days in the last 12 months OR a permanent resident who has lived in Australia for just as long to be eligible.

If any residence requirement is not met, purchasers may need to pay a penalty tax.

How to Apply for Off-The-Plan Stamp Duty Concession

Currently, the State Revenue Office manages concession applications relating to first home buyer off-the-plan purchases in NSW.

Here’s your step-by-step action plan for applying…

- Do your own thorough research before applying

- Confirm your Australian citizenship status and other personal conditions meet the application requirements

- Complete and lodge your application accurately and with supporting evidence

You can find further information and access the application form here.

New Requirements For Off-The-Plan Contracts To Know Before Your Contract Date

Prior to the date of the contract, check out the new requirements put into place in NSW from December 2019.

These new laws were added to create more disclosure obligations on vendors so that purchasers have more transparency throughout the buying process.

As a first home buyer, purchasing a residential property, like a new apartment, off-the-plan can offer some pretty sweet benefits, but please do keep in mind that suitability will always depend upon the individual circumstances of the purchaser.

Contact one of our expert property consultants at Liviti to help answer any of your questions or take a look at our latest off-the-plan properties available for purchase.

Happy house hunting!

Is stamp duty payable on off the plan purchases in NSW?

It certainly is! Unless you meet any of the concession options mentioned in this article, your stamp duty payment will be due within 3 months of the completion of the transaction.