Can you buy a house with your super? This question is increasingly common among Australians looking to leverage their superannuation for property investment. While it’s not possible to directly buy a house to live in with your super, using a Self-Managed Super Fund (SMSF) to invest in property can be an option.

This article explores the intricacies of using superannuation for property investment, detailing the rules, benefits, and risks involved.

Key Takeaways

- Understand the basics of using your superannuation for property investment.

- Explore the rules and regulations surrounding Self-Managed Super Funds (SMSFs).

- Learn the benefits and risks of buying a property with your super.

Understanding Superannuation

What is Superannuation?

Superannuation, or super, is a system where money is placed into a fund to provide for your retirement. In Australia, mandatory contributions are made by your employer, and you can also make voluntary contributions.

Types of Superannuation Funds

- Industry Funds: Not-for-profit funds managed by industry bodies.

- Retail Funds: For-profit funds run by banks or investment companies.

- Self-Managed Super Funds (SMSFs): Private funds managed by individuals.

Why Consider Using Super for Property Investment?

Using super for property investment can diversify your retirement portfolio, potentially offering higher returns than traditional investments.

Self-Managed Super Funds (SMSFs)

What is an SMSF?

An SMSF is a private super fund you manage yourself. It can have up to four members, all of whom are trustees responsible for managing the fund and complying with regulations.

Benefits of SMSFs

- Control: Direct control over investment choices

- Flexibility: A wider range of investment options, including property

- Potential Tax Benefits: Lower tax rates on earnings within the fund

Responsibilities of SMSFs

- Compliance: Adhering to strict regulations set by the Australian Taxation Office (ATO)

- Record-Keeping: Maintaining accurate records of all transactions and investments

- Auditing: Annual audits by an approved SMSF auditor

Rules and Regulations of Buying A House with Super Fund

Can You Buy a House with Your Super?

Directly buying a house to live in with your super is not allowed. However, an SMSF can purchase property as part of its investment strategy, provided it complies with certain rules.

Key Rules for Property Investment with SMSFs

- Sole Purpose Test: The property must be used to provide retirement benefits for the fund’s members.

- No Living or Renting: Fund members and their relatives cannot live in or rent the property.

- Arms-Length Transactions: All transactions must be conducted on a commercial basis.

Borrowing to Buy Property with an SMSF

SMSFs can borrow money to purchase property using a Limited Recourse Borrowing Arrangement (LRBA). Under an LRBA, the loan is secured against the property, but the lender’s recourse is limited to the property itself.

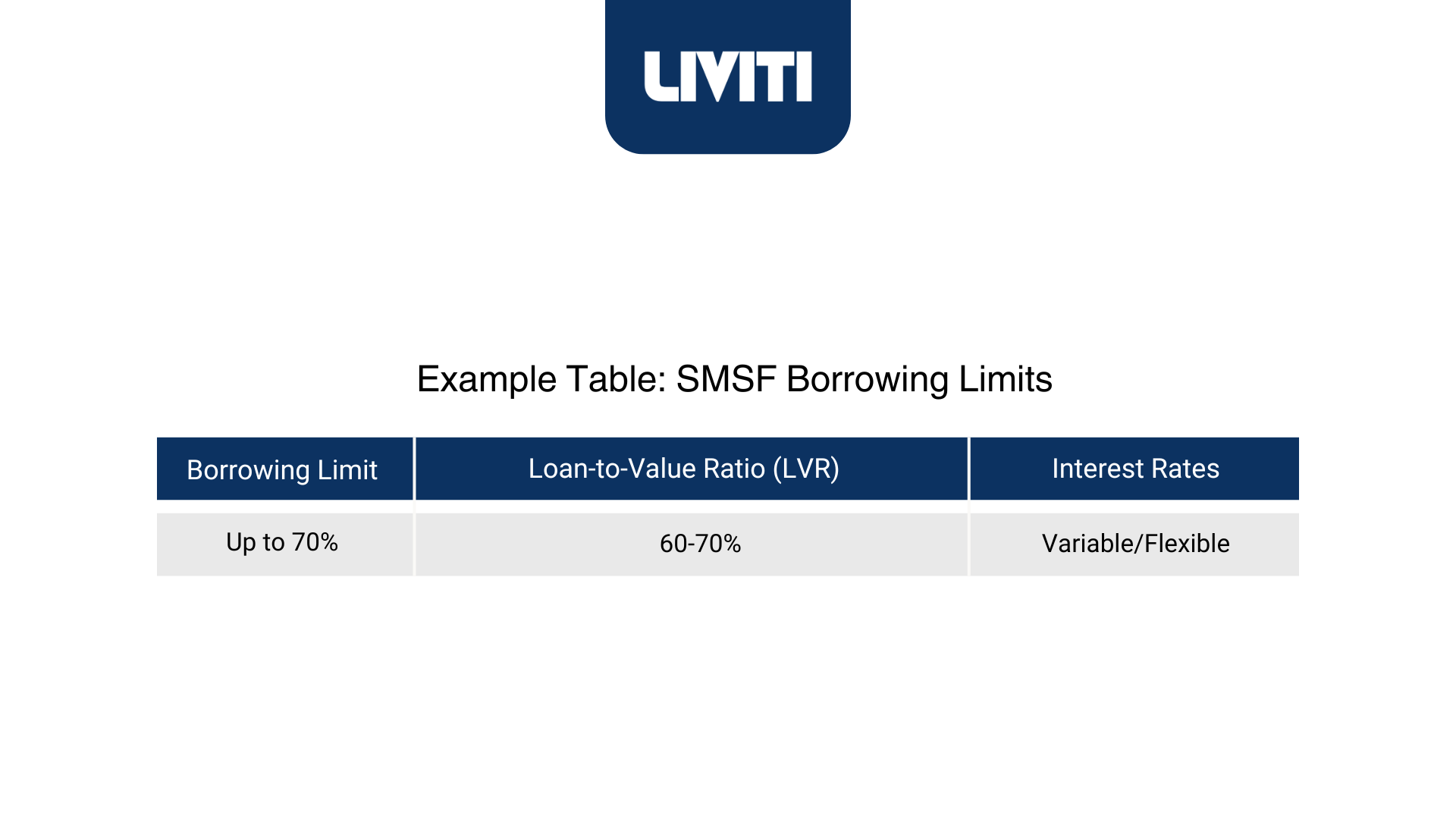

Example Table: SMSF Borrowing Limits

The example table for SMSF Borrowing Limits illustrates typical borrowing conditions for Self-Managed Super Funds when purchasing a property. It shows that SMSFs can usually borrow up to 70% of the property’s value, with a Loan-to-Value Ratio (LVR) of 60-70%, under variable or flexible interest rates.

This setup allows SMSFs to leverage their existing assets while ensuring the loan is secured against the property itself.

Benefits of Using Your Super for Property Investment

Diversification

Investing in property through your superannuation can add a valuable layer of diversification to your retirement portfolio. Diversification involves spreading your investments across various asset classes, such as shares, bonds, and real estate, to reduce overall risk.

By including property in your investment mix, you mitigate the impact of market volatility on any single asset class. For instance, if the stock market experiences a downturn, the value of your property investment might remain stable or even increase, balancing out potential losses and contributing to a more resilient portfolio.

Potential for Higher Returns

Property investment within an SMSF can yield significant capital growth and steady rental income, potentially outperforming traditional super investments like shares or bonds.

Over the long term, property values in Australia have shown a tendency to appreciate, offering substantial capital gains. Additionally, rental properties can provide a consistent income stream, enhancing the overall return on investment.

These higher returns can significantly boost your retirement savings, enabling you to achieve your financial goals more effectively and enjoy a comfortable retirement.

Tax Advantages

Investing in property through an SMSF offers several tax benefits that can enhance your investment returns:

- Concessional Tax Rates: Income generated within an SMSF, such as rental income or interest from investments, is taxed at a concessional rate of 15%, which is lower than the personal income tax rates for most individuals. Additionally, if the property is held for more than 12 months, capital gains are taxed at a reduced rate of 10%. This concessional treatment can result in substantial tax savings, increasing the net return on your investment.

- Tax-Free Income: Upon retirement, the income derived from SMSF investments, including rental income and capital gains, can become tax-free if the fund is in the pension phase. This means that you can enjoy the full benefits of your property investment without any tax liabilities, significantly boosting your retirement income. This tax-free status can make property investment through an SMSF an attractive option for maximising your retirement savings and financial security.

By leveraging these tax advantages, you can optimise your investment strategy, enhance your returns, and build a more robust financial future.

Risks and Considerations

Compliance Risks

Failing to comply with SMSF regulations can result in severe penalties, including the loss of tax concessions.

Market Risks

Property markets can be volatile, and there’s no guarantee of capital growth or rental income.

Liquidity Issues

Property is a less liquid asset compared to shares or bonds, making it harder to quickly sell and access funds if needed.

Costs

Setting up and maintaining an SMSF can be costly, including fees for administration, auditing, and professional advice.

Steps to Buying Property With Your Super

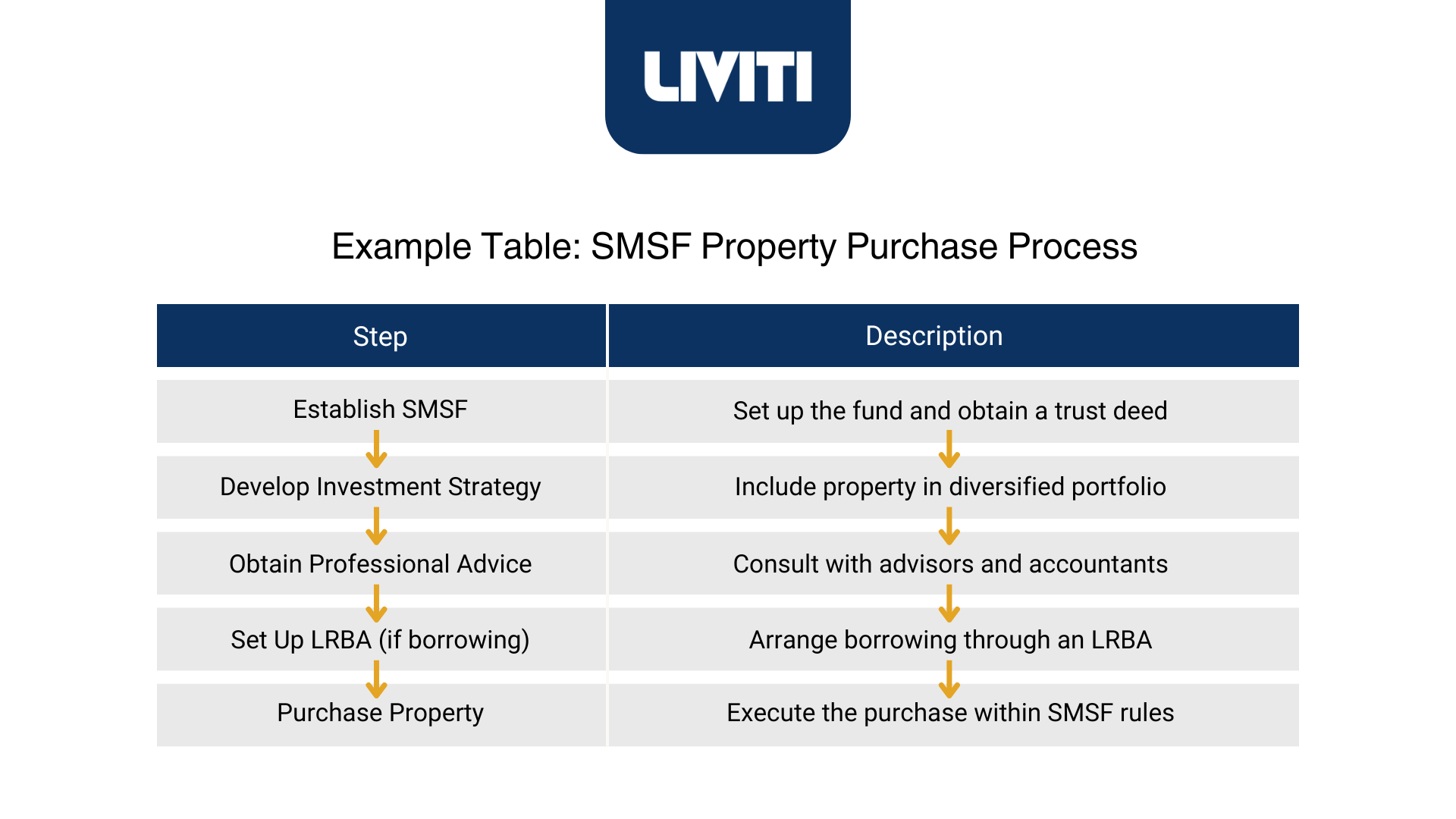

Step 1: Establish an SMSF

Set up an SMSF with up to four members, all of whom will be trustees. Ensure compliance with ATO regulations and obtain a trust deed.

Step 2: Develop an Investment Strategy

Create a comprehensive investment strategy that includes property investment as part of the diversified portfolio.

Step 3: Obtain Professional Advice

Consult with financial advisors, accountants, and legal professionals to ensure compliance and make informed decisions.

Step 4: Set Up an LRBA (if borrowing)

If borrowing to purchase property, set up a Limited Recourse Borrowing Arrangement and ensure all terms comply with ATO regulations.

Step 5: Purchase the Property

Execute the property purchase, ensuring all transactions are at arm’s length and comply with SMSF regulations.

Example Table: SMSF Property Purchase Process

Conclusion

Using your super to invest in property can be a lucrative way to grow your retirement savings, provided you navigate the complexities and comply with regulations. By establishing an SMSF, developing a sound investment strategy, and seeking professional advice, you can make informed decisions and maximise the benefits of property investment through your super.

Stay informed, understand the risks, and make strategic choices to ensure a secure and prosperous retirement.

Read More: The First home Super Saver Scheme

Frequently Asked Questions (FAQs)

Can I use my super to buy an investment property?

Yes, you can use your super to buy an investment property through an SMSF, provided it complies with ATO regulations and serves the sole purpose of providing retirement benefits.

How much can I borrow for an investment property with my super?

The borrowing capacity depends on the fund’s assets and the lender’s criteria. Typically, SMSFs can borrow up to 70% of the property’s value through an LRBA.

How do I buy an investment property with my super?

To buy an investment property with your super, you need to establish an SMSF, develop an investment strategy, possibly set up an LRBA for borrowing, and ensure all transactions comply with SMSF regulations.

What is an investment property in an SMSF?

An investment property in an SMSF is a property purchased to provide retirement benefits for the fund’s members. It must comply with the sole purpose test and other ATO regulations.

How do I invest in property with my super?

To invest in property with your super, set up an SMSF, create a diversified investment strategy including property, consult with professionals, and ensure compliance with ATO rules.

How much deposit do I need for an investment property with my super?

Typically, SMSFs need a deposit of at least 30-40% of the property’s value when using an LRBA. The exact amount depends on the lender’s requirements and the fund’s financial position.