As we step into 2025, the Australian property market is poised for significant transformation, driven by economic indicators such as the consumer price index (CPI).

The latest report from the Australian Bureau of Statistics (ABS) reveal that the Consumer Price Index (CPI) edged up by 0.2% in the December 2024 quarter, bringing the annual inflation rate to 2.4%, with housing and property investment sector being one of the key contributors to this upward trend.

This article delves into the implications of these CPI changes for property investment experts, first time property investors, and those looking to build wealth through real estate.

Current Consumer Price Index (CPI) in Australia

The consumer price index is a vital measure reflecting national inflation and the cost of living. In December 2024, the annual CPI increase was noted at 2.4%, a slight decline from 2.8% in the previous quarter. This indicates a stabilising inflation environment, which is crucial for potential investors as it suggests a more predictable economic landscape.

According to Michelle Marquardt, Head of Prices Statistics at the ABS, this quarterly increase mirrors the 0.2% rise recorded in September 2024. Notably, these minimal movements represent the lowest CPI growth since June 2020, a period marked by the economic disruptions of COVID-19, when childcare was temporarily free.

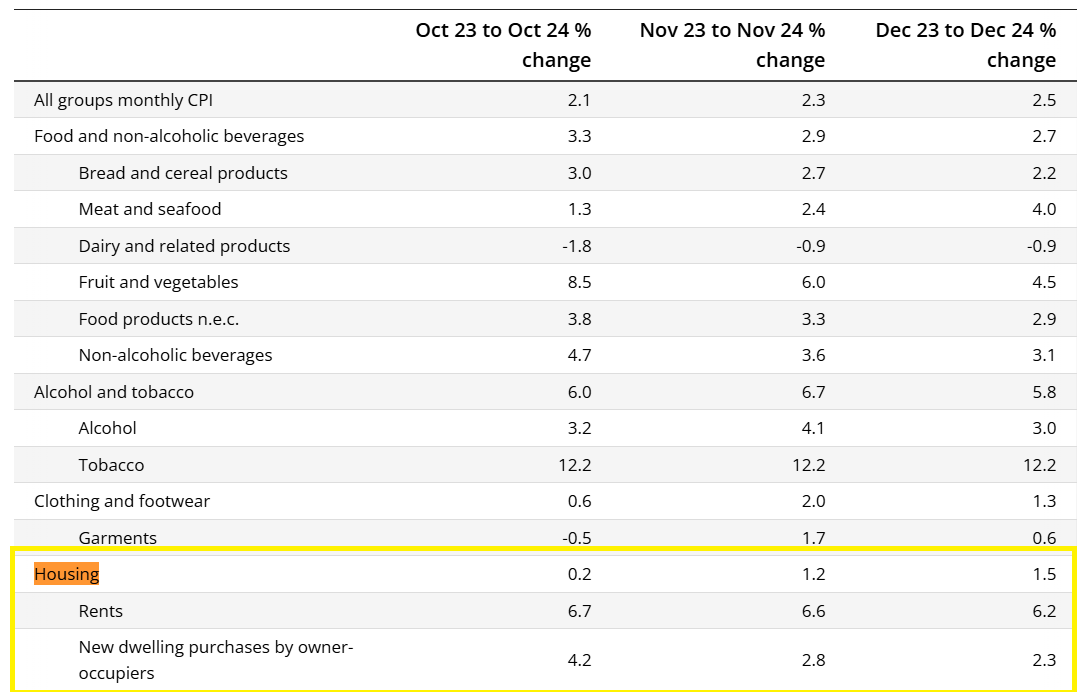

During the period from October 2023 to October 2024, the housing sector there was a increase of CPI of 0.2%. From November 2023 to November 2024, there was a increase of CPI of 1.2% and from December 2023 to December 2024 the CPI increased again to 1.5%.

On an annual basis, the 2.4% inflation rate for December 2024 signals a decline from 2.8% in the previous quarter, reinforcing the trend of moderating inflation.

Key Contributors to CPI Movement

Among the various categories influencing the CPI, housing saw a notable increase of 1.5%. This rise is particularly significant for property investors as it underscores the resilience of the real estate market amidst fluctuating economic conditions.

With housing costs continuing to climb, investing in property remains a strategic avenue for wealth accumulation for most of the Aussies.

A Promising Environment for Property Investors in 2025

The current CPI trends indicate a robust demand for housing, which is expected to continue into 2025 and afterwards. As property prices rise, so too does the potential for capital growth for those who are willing to build profitable investment portfolios.

Investors should consider this upward trajectory when evaluating their portfolios or contemplating new acquisitions.

With rental prices increasing alongside property values, investors can expect enhanced rental yields. The easing of inflationary pressures may also lead to more stable rental markets, making it an opportune time for investment.

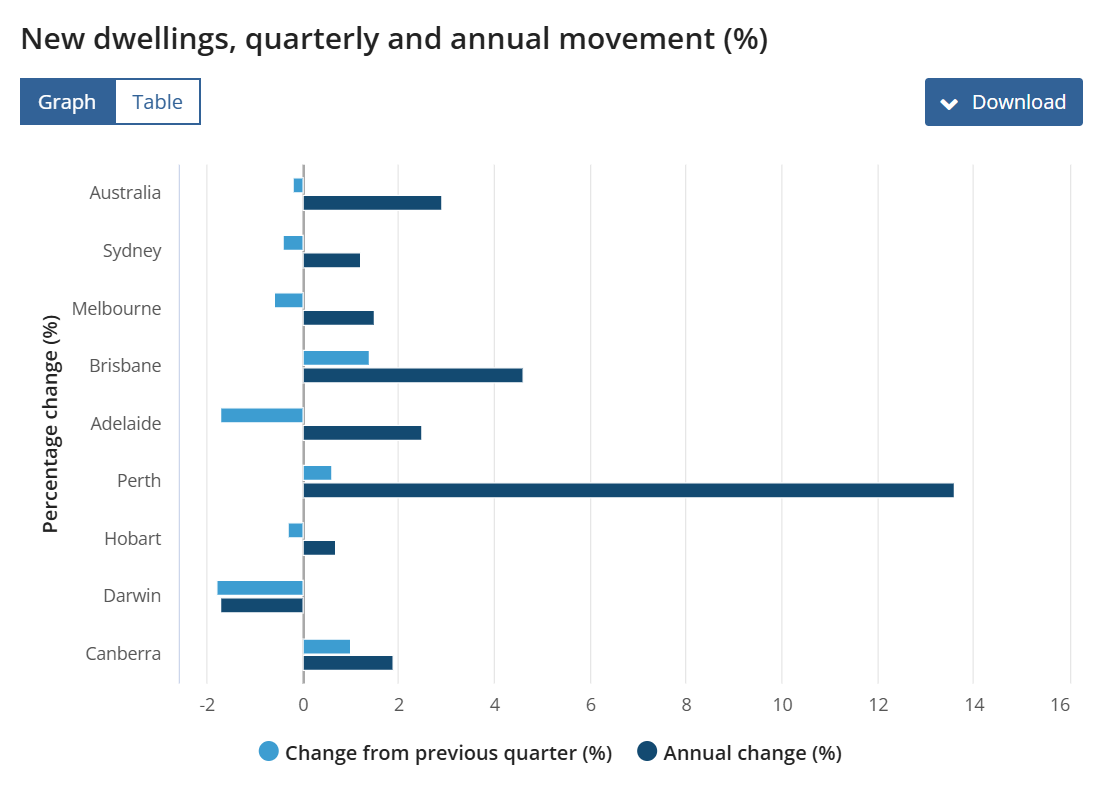

The recent data also indicates that new dwelling prices have seen fluctuations but remain an essential focus area for investors. While new dwelling prices dropped by 0.2% in the December 2024 quarter, this was the first fall since June 2021. Such trends suggest that savvy investors can find opportunities in emerging real estate market where demand is still very strong and promising.

As Australia’s population continues to grow, driven by immigration and urbanisation, the demand for housing will only intensify. This demographic shift presents an opportunity for property investors to capitalise on long term growth potential in both metropolitan and regional areas.

Strategic Considerations for First Time Investors

For first time property investors or first time property buyers looking to enter the market in 2025, understanding the dynamics of the current CPI in Australia is crucial:

Research Emerging Markets: Identifying suburbs with high growth potential can yield significant returns. Areas experiencing infrastructure development or population influx are ideal targets.

Sustainable Investments: Properties that incorporate energy-efficient features are gaining traction among buyers and renters alike. Investing in sustainable properties not only meets market demand but also enhances long-term value.

Leverage Financial Tools: With interest rates stabilising and potential cuts on the horizon, now is an advantageous time to explore financing options that can maximise your investment capacity.

As we navigate through 2025, understanding the nuances of the consumer price index will be essential for property investment experts and newcomers alike. The combination of rising housing costs and stabilising inflation creates a conducive environment for investment opportunities across Australia’s diverse real estate landscape.

Read More: NSW and QLD Consider Changes to Stamp Duty Laws in 2025

Frequently Asked Questions (FAQs)

1. What is consumer price index?

The Consumer Price Index (CPI) measures the average change in the prices of goods and services households buy over time, helping track inflation and the cost of living in Australia.

2. What is the current consumer price index in Australia?

The current consumer price index in Australia rose by 2.4% annually as of December 2024, indicating a stabilisation in inflation rates compared to previous quarters.

3. What are the key contributors to the recent CPI changes?

Housing and property investments contributed significantly to the CPI changes, with a notable increase of 1.5% recorded in December 2024, reflecting strong demand in the real estate market.