In Australia’s current economic climate, now it is more important than ever that first time property investors have the essential tools they need to generate wealth for themselves and for their loved ones. Among numerous metrics, gross rental yield is one of the most vital metrics, helping investors identify opportunities in property market to generate income, build wealth, and grow their investment portfolios.

If you are very new in the investment properties market, you might be wondering what is gross rental yield. Gross rental yield is the annual rental income received from a property, expressed as a percentage of the property’s purchase price, before taxes or expenses. It’s a simple yet effective measure to analyze a property’s income potential and assess its value.

To understand gross rental yield in a practical context, let’s consider a real-world example involving a property investment in Australia.

How Rental Yield Works:

Property Details:

- Purchase Price: $600,000

- Weekly Rent: $500

Step 1: Calculate Annual Rental Income

First, we need to calculate the total annual rental income from the property.

Annual Rental Income = Weekly Rent × 52

Annual Rental Income = $500 × 52 = $26,000

Step 2: Calculate Gross Rental Yield

Next, we can calculate the gross rental yield using the formula:

Gross Rental Yield = (Annual Rental Income / Property Value) × 100

Plugging in the numbers:

Gross Rental Yield = (26,000 / 600,000) × 100

Gross Rental Yield = 0.0433 × 100 = 4.33%

In this example, the gross rental yield of 4.33% means that for every dollar spent on purchasing the property, the investor earns approximately 4.33 cents in annual rental income before considering any expenses such as taxes, maintenance, or management fees.

Why Gross Rental Yield Matters

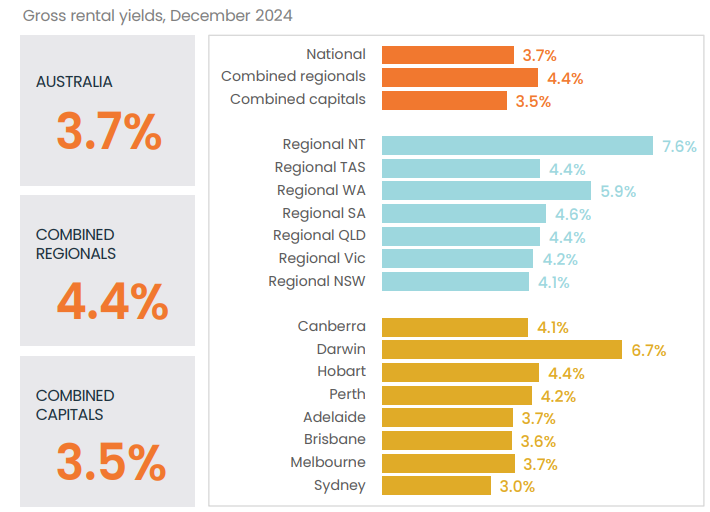

So why is gross rental yieldover 5% so important? Well, it typically shows a positive cash flow and a solid investment return. CoreLogic’s Monthly Housing Chart Pack reveals that in 2025, the average rental yield in Australia was 3.69%, with only Northern Territory, Western Australia and Darwin exceeding 5%.

This means that a 5% rental yield is above average and scarce. Therefore, achieving a yield of over 5% in 2025 is a tremendous, desirable achievement.

Gross rental yields are game-changers for first-time investors as with time, a well-managed investment property over an extended period will provide a second income to continue investing and expand your portfolio.

Higher yields reduce the time that it takes for the property to become profitable and increase the positive cash flow you receive, allowing you to offset any costs or debt faster and reinvest into yourself at a faster pace.

With a rental income, combined with your usual income, you can offset the cost of your mortgage and shorten the amount of time it would have taken you to pay it off without a second income. As well as this, any maintenance costs for properties you own can be covered.

What Does The Market Data Say?

Source: CoreLogic

CoreLogic’s Housing Data Reveals:

• Northern Territory: The highest state yield at 7.6%.

• Western Australia: The second highest state yield at 5.9%.

• Darwin: The leading capital city with a yield of 6.7%.

• New South Wales: The lowest state yield at 4.1%.

• Sydney: The lowest capital city yield at 3.0%.

These gross rental yield figures further highlight that achieving a yield above 5% is scarce and highly desirable in today’s property market. The data deduces that the Northern Territory and Western Australia generate the highest average yield in the nation, and as such, have more immediate income potential.

However, this doesn’t paint the full picture. It can be incredibly expensive and unrewarding trying to buy a high-yield property when the market favours sellers over buyers. The Northern Territory and Western Australia, although averaging a higher yield, are currently in a seller’s market phase, where there’s a shortage of housing and as a result, the demand and prices for properties are higher than usual. Victoria, however, with a rental yield of 4.2%, is rapidly growing due to the government appointed expansion from 2020-2040. Due to this, Melbourne is sprouting new suburbs with plenty of amenities and access to transport, ensuring demand for new housing. There’s no better time to invest in Melbourne than right now.

The Higher The Yield, The Higher The Reward

Focusing on higher-yield properties reduces the chances of obtaining a property that can’t cover its expenses, causing a negative cash flow. High rental yields are ideal for first-time investors as it offers cash flow stability, which they can comfortably use to cover personal costs and create an income stream. Later on, first-time investors can use this stream to finance further investments and grow their portfolios.

By reinvesting rental returns into your portfolio, you can benefit from compound growth. Over time, this strategy amplifies your wealth, as each year’s returns build upon the previous year’s total. This compounding effect can significantly increase your returns and create a solid foundation for financial security and new investment opportunities to pursue.

How To Spot A High Yielding Property in Australia

To identify high-grossing yield properties, you must consider several factors. These include the location, the amenities of the property and the proximity of public amenities, such as education centres and hospitals. The property’s condition is also important, especially since you need to hold onto the property long enough to offset any costs and provide a consistent rental income.

Comprehensive research is essential before committing to a property, to ensure that your investments have the opportunity to grow and develop. Leveraging resources like CoreLogic’s market reports helps you understand trends from the national level to specific capital cities, ensuring informed investment decisions. Staying informed in the property market is essential to succeeding and growing your portfolio.

What are the Possible Challenges To Consider

As an investor, it’s important to balance the need for short-term cash flow for expenses with the goal of long-term equity. High-yield properties can generate short-term income, whilst value growth over time provides significant equity gains on a long-term scale.

When it comes to deciding on a property, vacancy rate should also be taken into account. A low vacancy rate suggests many renters, whereas a high vacancy rate suggests fewer. Higher vacancy means a more unstable income, higher costs to maintain, and an overall reduction in profitability. Several factors, like location and condition, contribute to a property’s vacancy rate and should be researched before deciding on a property, to avoid any potential losses.

Do you know there are numerous facts shared about real estate and property investment on social media nowadays? But do they actually reflect the true scenario of the investment property industry? Get to know more from the expert’s of Liviti below:

Conclusion

As the cost of living rises, it is essential for first-time investors to have the knowledge to make informed decisions to secure financial stability. Gross rental yield offers a powerful pathway to creating a second income, offsetting costs, and building long-term wealth.

At Liviti, we specialize in helping new investors navigate the property market with confidence. Book a free consultation with us today to explore high-yield opportunities and take the first step towards building your financial future.