Understanding the impact of interest rates on investment property is crucial for success in the dynamic world of real estate investment. These rates influence your monthly payments and affect the ongoing costs of your investment, rental yield, and potential for long-term growth.

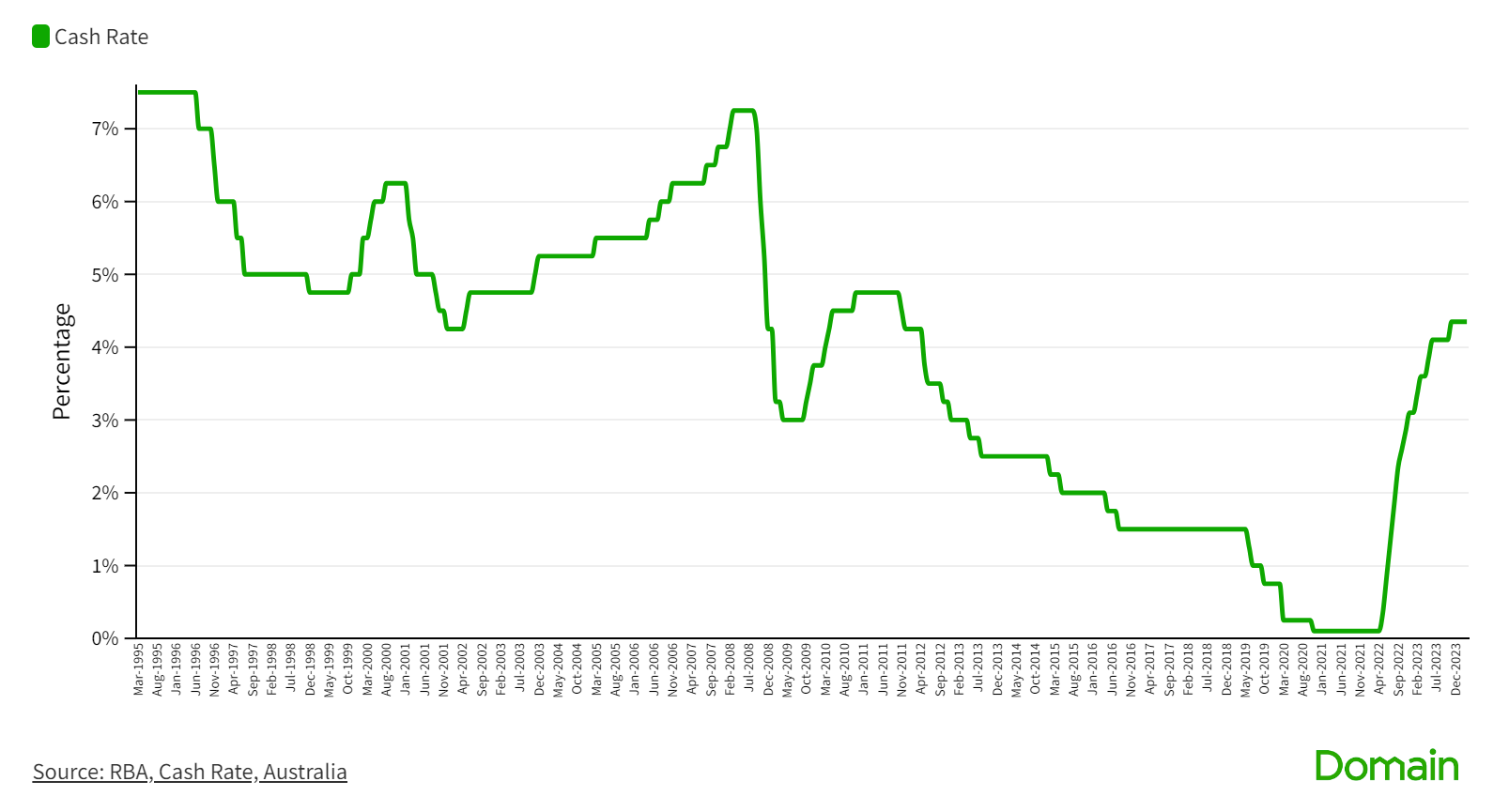

It is normal for interest rates to fluctuate. A large factor of these interest rate shifts is called the cash rate. The cash rate plays a key role in influencing the Australian property market.

Key Takeaways

- Interest rates on investment property directly affect the cost of borrowing.

- The relationship between cash rates and interest rates on investment property is pivotal for investors to understand.

- Rising interest rates on investment property can significantly impact investment strategies.

- Choosing between fixed-rate and variable-rate mortgages requires careful consideration.

- Preparation for rising interest rates on investment property is essential for maintaining investment viability.

- Investors can use interest rates on investment property to their advantage through strategic planning and understanding market dynamics.

What is a cash rate?

The cash rate is decided after analysing inflation rates and open market activity by central bank systems which, in the case of Australia, is the Reserve Bank of Australia (RBA). This linkage is crucial for controlling inflation and stabilising the economy.

The updates on cash rates, among other factors, determine interest rates for a certain period and affect prices for big investments such as home loans and investment properties. The RBA governing body is scheduled to have 8 meetings in 2024, each crucial in adjusting the cash rate as per economic activities and inflation rates. You can stay updated on these meetings here.

Understanding these intricacies is essential in making investment decisions. This comprehensive guide below can help you to get versed on interest rates, impact decisions on investment properties, their impact, and strategies to leverage these rates for optimal investment outcomes.

RBA Keeps Cash Rate at 4.35%

In the latest March monetary policy meeting on March 19th, the Reserve Bank of Australia (RBA) announced the cash rate to stay at 4.35%.

The decision was largely expected, as the latest Australian Bureau of Statistics data showed annual inflation fell to 3.8% in January, down from 4.0% in December.

While higher interest rates appear to be having the desired effect on the economy, RBA governor Michele Bullock reiterated the RBA’s commitment to return the cash rate to within its target range of 2-3%.

Domain’s chief of research and economics Dr Nicola Powell is predicting rate cuts later in 2024. In the latest Domain article, she mentions how the current wage increases and higher migration rates are pushing back rate cuts to later in the year. She also said, “Historically, this has played out positively for the housing market, resulting in a lift in consumer sentiment, which tends to drive a positive outcome for housing turnover.”

What is an Interest Rate?

Understanding the Basics

Interest rates represent the cost of borrowing money, expressed as a percentage of the total loan amount. For investment properties, this rate determines the monthly payments and the total interest paid over the life of the loan.

The Role of Interest Rates in Real Estate Investment

Interest rates are a critical factor in real estate investment. They influence the affordability of loans, the attractiveness of investment properties, and the strategies investors use to maximise returns.

How Do Interest Rates Affect Investment Property?

The Direct Impact on Monthly Payments and Total Loan Cost

Higher interest rates on investment property mean higher monthly payments and a greater total cost of borrowing. This can reduce borrowing capacity, cash flow and the overall profitability of an investment property.

The Effect of Interest Rates on Property Values and Investment Appeal

Interest rates on investment property also indirectly affect property values. Lower rates can increase demand for properties, driving up prices, while higher rates may cool down the market.

Why is the Interest Rate Linked to the Cash Rate?

Implications for Investors

Australian investors must monitor Reserve Bank of Australia (RBA) policies and cash rate trends, as these can signal changes in interest rates on investment property that may affect investment property financing and strategy.

Why Are Interest Rates Rising?

Economic Recovery and Inflation

Interest rates often rise in response to strong economic growth and rising inflation. The RBA may increase rates to prevent the economy from overheating and to keep inflation in check.

Impact of Interest Rates on Investment Property

Rising interest rates can decrease borrowing capacity, potentially slowing down the real estate market. However, they can also indicate a strengthening economy, which may increase rental demand and property values over time.

Fixed Rate Mortgage vs. Variable Rate Mortgage

Understanding the differences between fixed-rate and variable-rate mortgages is essential.

Fixed-rate mortgages offer predictability in monthly payments, while variable-rate mortgages can fluctuate over time based on market conditions, affecting monthly payments and total loan cost. Fixed-rate mortgages provide stability but may result in higher costs if interest rates on investment property decrease.

Variable-rate mortgages are more directly impacted by changes in interest rates on investment property, making them riskier during periods of rate increases.

Learn more about the types of loans available for investment properties.

How Can I Prepare My Investment Properties for Rising Interest Rates?

Investors can prepare for rising interest rates on investment property by understanding whether they have a fixed or variable rate and keeping track of when their fixed rate period ends.

Making extra repayments can reduce the principal faster, decreasing the total interest paid.

Considering refinancing your loan can lead to significant savings over time.

Building a buffer in your offset account can provide financial flexibility, and ensuring stability in your rental properties focuses on tenant retention to maintain steady rental income. Investing in property maintenance enhances value and appeal.

By understanding the nuances of interest rates on investment property and their impact, investors can make informed decisions to navigate the complexities of the real estate market.

The strategies outlined provide a roadmap for leveraging interest rates on investment property to enhance investment outcomes, ensuring long-term success in the property market.

Finding the Best Interest Rates for Investment Property

In the competitive realm of real estate investment, securing the best interest rates on investment property is pivotal. Use the following steps to outline how you can navigate the process of finding, negotiating, and leveraging the best interest rates for investment property to enhance your investment’s profitability and growth potential.

Research and Comparison for Optimal Rates

Utilising Online Comparison Tools

In the digital age, you can find several online tools designed to compare various mortgage products, highlighting their interest rates, fees, and features, all tailored for investment properties. These platforms are invaluable for investors seeking the best investment property interest rates.

Consulting with Mortgage Brokers

Mortgage brokers are the unsung heroes in the quest for the best interest rates for investment property. Their expertise and connections can unlock exclusive offers and deals that are not widely advertised, ensuring you get competitive investment property loan rates.

Negotiating with Lenders

Leverage Your Creditworthiness

A robust credit score and a stable income are your best allies when negotiating interest rates for investment properties. These factors can significantly sway lenders to offer you better terms on your investment property loan.

Price Matching

In a market where interest rates on investment property can vary significantly between lenders, finding a lower rate and asking your current lender to match it can result in substantial savings.

Strategies to Reduce Your Interest Rates

Refinancing at the Opportune Moment

Keeping a vigilant eye on market trends to refinance your investment property can lead to lower interest rates than your current mortgage. This strategic move requires balancing refinancing costs against the potential savings on your investment property interest rate.

Opting for Shorter Loan Terms

Although shorter loan terms come with higher monthly payments, they typically offer lower interest rates. This approach can drastically cut the total interest paid over the lifespan of your investment property loan.

Leveraging Interest Rates For Your Investment Properties

Rental Performance

In environments where interest rates are climbing, adjusting your rental prices to cover these increased costs can maintain or improve your investment property’s profitability. Moreover, investing in the appeal of your property can justify higher rents and attract quality tenants, offsetting the interest rate investment property expenses.

Tax Exemptions and Depreciation

The tax-deductibility of interest on investment property loans offers a buffer against the cost of rising rates. Additionally, maximising depreciation deductions can further mitigate the impact of higher interest rates on your cash flow.

How to Enhance Buying Power in a High-Interest Market

Market Timing

A market experiencing higher interest rates can see a cooling effect on property prices, though across capital cities in Australia, this is usually not the case. This scenario in some smaller regions can present a golden opportunity to acquire investment properties at lower prices, leveraging the best investment property mortgage rates.

Negotiation Leverage

A slower market gives buyers with robust financing options increased leverage in price negotiations, potentially leading to better deals and more favourable investment property rates.

Tips for Securing Lower Interest Rates For Your Investment Properties

Improving Your Credit Score

An excellent credit score can unlock lower interest rates for your investment property, making it crucial to maintain timely bill payments, reduce debt, and avoid unnecessary credit inquiries.

Making a Larger Deposit

A substantial down payment decreases the lender’s risk, often resulting in a lower interest rate for your investment property mortgage.

Interest-Only Loans: A Double-Edged Sword

While interest-only loans can lower initial payments, they may not always lead to long-term savings. Careful evaluation of your strategy and the market is essential when considering these types of loans for your investment property.

By mastering these strategies, investors can effectively navigate the complexities of interest rates on investment property. Staying informed, planning strategically, and adapting to market conditions is key to leveraging interest rates to your advantage, ensuring the success and growth of your real estate investments.

Frequently Asked Questions

1. How do rising interest rates affect real estate investments and the market?

Rising interest rates increase the cost of borrowing, leading to a cooling-off phase in the real estate market.

For investors, this means higher mortgage payments, potentially lower cash flow, and a need for careful financial planning. The increased cost can also deter new buyers, leading to a slower rate of price appreciation.

However, it can also mean less competition for savvy investors looking to purchase properties.

2. What impact do higher interest rates have on rental prices, particularly in Australia?

Higher interest rates can lead to increased rental prices as property investors look to cover their higher mortgage costs.

However, the ability to raise rents is influenced by the local rental market’s demand and supply dynamics. In areas with high demand and low supply, investors may successfully pass these costs onto tenants.

Conversely, in markets with ample supply, raising rents may not be feasible.

3. How can investors prepare for and mitigate the impact of rising interest rates?

Investors can prepare for rising interest rates by:

- Locking in fixed-rate mortgages to secure current rates for a period.

- Increasing their rental property’s cash flow through rent adjustments and operational efficiencies.

- Refinancing existing mortgages to take advantage of any lower rates or better terms before rates climb further.

- Building a financial buffer to absorb potential increases in mortgage payments.

- Diversifying their investment portfolio to spread risk.

4. Who gets the extra money generated by higher interest rates?

The “extra money” from higher interest rates primarily benefits lenders, including banks and financial institutions, as they receive higher interest payments on the loans they issue.

This can lead to increased profits for these entities, assuming that the rate of loan defaults with no significant increase due to borrowers’ inability to meet higher payment obligations.

5. How does the cash rate affect interest rates, and what’s the impact on investment property mortgage rates?

The cash rate, set forth by central banks like the RBA, is a benchmark for interest rates, influencing lending and borrowing rates across the economy, including those for investment properties.

When the cash rate rises, lenders typically increase their interest rates for both existing and new loans, leading to higher mortgage payments for property investors. Conversely, a decrease in the cash rate often leads to lower interest rates, making borrowing cheaper.

6. What factors determine investment property mortgage rates?

Several factors determine investment property mortgage rates, including:

- The central bank’s cash rate.

- Lender-specific policies and risk assessments.

- The investor’s credit score and financial history.

- The loan-to-value ratio (LTV) of the property.

- Market competition and economic conditions.

7. How have mortgage rates historically affected housing investment and market dynamics?

Historically, low mortgage rates have stimulated housing investment and market activity by making borrowing more affordable, thus increasing buyer affordability and demand. This often led to price increases.

High mortgage rates, on the other hand, can slow down the market, reduce buyer affordability, and put downward pressure on prices as fewer people can afford to borrow.

8. What advice would you give to established and upcoming investors regarding interest rates and real estate investment?

Established investors should review and possibly refinance existing loans to secure better rates or terms. They should also think about diversifying their investments to mitigate risks associated with rising rates.

Upcoming investors will do good by focusing on financial education and understanding market cycles. Additionally, start with a solid financial foundation, including a good credit score and a financial buffer. Consider the long-term implications of fixed vs. variable rates based on your investment strategy.

9. How do lower interest rates affect real estate pricing and investment strategies?

Lower interest rates decrease the cost of borrowing, making financing more accessible and affordable. This typically leads to increased demand for real estate, pushing up property prices.

For investors, lower rates can improve cash flow through cheaper financing costs, making it an opportune time to buy or refinance properties.

10. What are the implications of long-term high mortgage rates for the real estate market and investors?

Long-term high mortgage rates can lead to decreased affordability for buyers, potentially slowing down the real estate market.

Investors may see reduced capital gains and may need to adjust their strategies, focusing more on rental income and operational efficiencies to maintain profitability. It also emphasizes the importance of selecting properties in locations with strong rental demand to ensure steady cash flow despite higher borrowing costs.