Deciding whether or not buying off the plan is the direction you would like to go in can be a rather daunting and tedious experience, especially for first home buyers.

To help de-mystify this subject, our experienced team at Liviti have compiled a list of questions you should ask when buying off the plan.

1. What is off the plan?

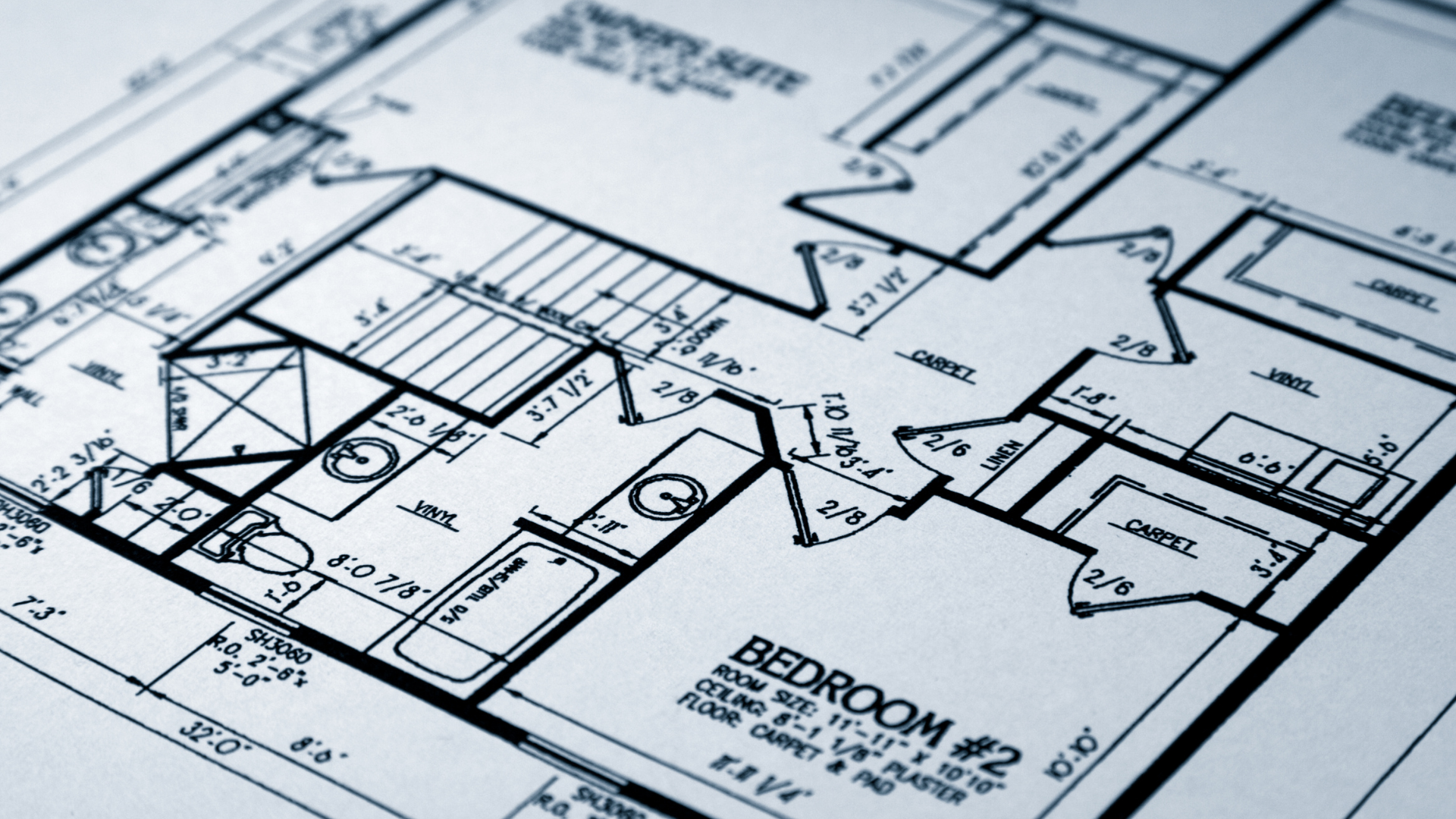

Pretty much, buying off the plan is when you sign a contract to purchase a property before the construction is complete or has even started. When purchasing an off the plan property, you won’t be able to see the completed product until it’s, well completed. So you can be quite dependent on floor plans, render images and display rooms.

Therefore, it is important that you conduct your own research as well as seek professional advice when securing an off the plan purchase to ensure you are making the right decision.

2. Why should I buy off the plan property?

There are many advantages to buying off the plan, the main one being that it can save you a lot more money than if you were to purchase an already established property. This is because a purchase price is agreed upon before the construction period and generally, only a small deposit is needed.

Some other financial benefits include:

- Capital growth on your property prior to completion – the market price could grow significantly from the time you buy the project to the time it is complete.

- Tax benefits can also be available for investors during this process that can be claimed on your tax return.

3. How much deposit do I require and is it secure?

The deposit required to purchase off the plan differs from person to person and their unique situations. Generally, a 10% deposit bond is required to secure an off the plan property. However, under the First Home Loan Deposit Scheme, only a 5% deposit is required by the buyer if they are buying their first home, while the remaining balance will be guaranteed by the Australian Government.

And yes, it’s secure!

The deposit is kept securely in a solicitor’s trust account during the construction period or until the sunset period expires that cannot be released by the developer.

4. What is the timeline between deposit and completion?

The timeline starts from when you put your deposit down to the end of the construction period, generally from 6 months to 3 years.

Don’t stress though, there are some advantages to having this gap in between. It can give you some more time to get your finances in order before you need to make any more payments and there’s the possibility of earning interest on the cash deposit you put down.

5. Will my apartment be similar to the floor plans and brochure?

Display units are what people generally trust most, as it presents the finishes and appliances that the completed apartment will hold.

However, other reliable documents include:

- Floor plans – show the layout of the property to scale

- Designs – emulates what the finished product will look like

- Computer Generated Images or 3D tours – makes you feel as though you are actually walking through the completed apartment.

Often, a property contract will contain a clause entitling the developer to make minor changes to the floorplan and/or substitute unavailable products with similar ones. This is why it is very beneficial for you to work with a trusted developer whose project history you are aware of.

6. Are there any incentives to buy off the plan?

As aforementioned, there is an agreed-upon price prior to the completion of the building. If property prices in the area increase during the construction period, you could end up paying a lot less than it’s worth when you move in. What a steal!

This is definitely not the only incentive price-wise to buying off the plan – you could also save a lot of money if you are eligible for stamp duty concessions and through some government grants that may apply to first home buyers.

7. Will I be eligible for the First Home Owner Grant (FHOG)?

The First Home Owner Grant is available to those purchasing their first property, that they will then live in. Although the amount varies from state to state, in NSW you could be eligible for a $10,000 grant. You can check your eligibility and find out more here.

8. What tax benefits are there?

The two major tax benefits for investors when buying off the plan are depreciation savings and negative gearing.

Depreciation Savings

Depreciation savings are highest in the first year where you can claim on the building as well as the fittings and fixtures. It is favourable to use a reputable quantity surveyor (whose fees are tax-deductible by the way!) to create a depreciation schedule for you in order to ensure you are saving as much as possible during this time.

Negative Gearing

Negative gearing is a beneficial tax break for investors, especially those on a higher salary. It occurs when there is a shortfall where your mortgage costs are not entirely covered by your rent and the difference needs to be made up from your own pocket. It can be claimed against your tax return throughout the year from each pay or at the end of the year.

9. What is Strata?

Strata Levies are fees you need to pay to the Owners Corporation for the running costs of the building.

How much is strata?

There’s no fixed standard for strata fees. They tend to vary from scheme to scheme depending on how many communal facilities there are and other factors. In New South Wales, the average cost can be anywhere from 0.3% to 1.2% of the property’s value.

The different types of Strata Levies

Combined with the one payment are three different types:

- Administrative Fund Levy – takes care of daily expenses such as cleaning, utility fees and facility management charges.

- Sinking Fund or Capital Works Levy – finances large ongoing capital expenditures like anticipated expenses for exterior repairs and repainting.

- Special Levy – takes care of unexpected costs to ensure the complex is safe to live in.

10. Is buying off the plan safe?

Yes, it is! It’s also often less volatile compared to other investment types. However, it’s important to carefully examine the risks associated with this process.

The Risks Involved

- Unexpected delays

- The possibility of the developer going bankrupt

- The finished property might not directly align with your expectations

- The sunset clause expires before the property is completed

By conducting research, seeking professional advice, being aware of your developer’s previous projects and ensuring it sits comfortably within your budget, you can avoid financial risks and disappointment surrounding the process.

11. When is the best time to buy off the plan?

There’s no real best time to buy a property off the plan. Ideally, you want to be buying within a market before the peak to capitalise on the growth.

However, if:

- You are financially stable enough to buy a property in today’s market

- You have your deposit ready

Then NOW is the best time to buy before the market goes up.

12. What happens if the market changes?

Market conditions and the interest rate are known to change rather sporadically. In the time a property is built, which usually takes at least a year, the rates could rise and conditions can change drastically. In order to reduce such a risk and avoid any major stress on your financial situation, it is important to ensure that the price of the property sits comfortably within your budget.

It is always a good idea to conduct a plan to mitigate risk and how you may approach any if they were to arise.

13. When is settlement?

Property settlement is a legal process where the ownership of a property is passed down to you from the seller and is assisted by both the seller’s and your legal and financial representatives.

The settlement date is set by the seller in the contract and while they can vary, usually, the settlement period is 30 to 90 days.

14. What is the sunset clause?

This is a statement in the contract that puts a time limit known as the sunset period, on the contract’s validity and states when the project needs to be completed by.

It is included to protect both the buyer and developer as if the property is not complete before the sunset period expires, a new contract is drawn up or the deposit is returned.

Conclusion

With a little bit of research, the right professional advice and adequate knowledge of your developer there are major benefits to purchasing off the plan up front and for many years after the purchase.

Working with a Property Consultant can also make this off the plan buying process far easier and our Property Consultants at Liviti are here to help you every step of the way. We deal with off the plan purchases every single day and thoroughly understand the property market and can find a suitable property tailored to your needs and requirements.