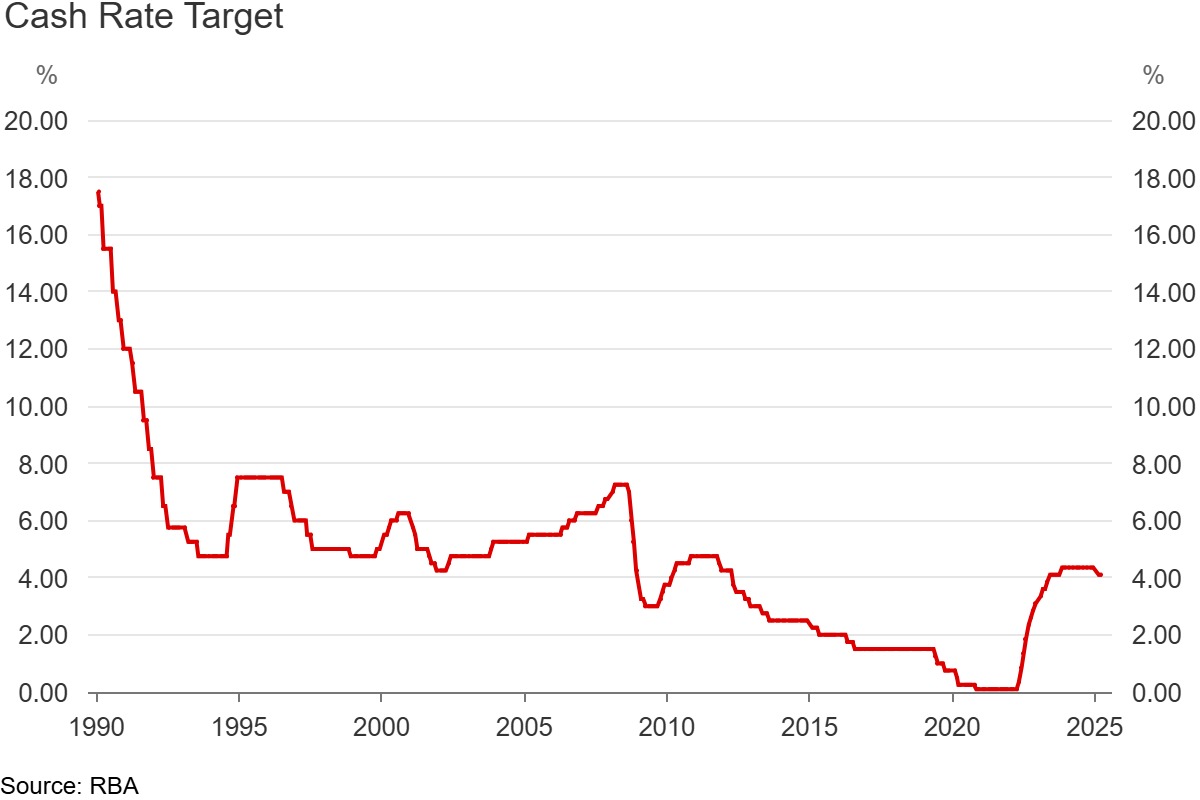

With the Reserve Bank of Australia set to lower its cash rate by 0.25 percentage points on 20 May 2025 based on market predictions, the 2025 Australian property market forecast is poised for renewed momentum. Below, we explore May 2025 data and expert analysis on how this cut will ripple through borrowing costs, dwelling values, and buyer behaviour.

2025 Australian Property Market Forecast: Cheaper Credit Fuels Price Growth

Lower Rates, Bigger Budgets

When the RBA cuts its cash rate, lenders typically trim mortgage rates. After theFebruary 2025 rate cut, national dwelling values rose 0.3% in March. Analysts now project that the May cut could sustain +3% annual growth in home values.

Where Gains Will Be Strongest

- Capital Cities: Sydney and Melbourne despite high entry prices often rebound sharply when borrowing costs fall, thanks to deep demand pools and auction competition.

- Regional Markets:Undersupplied areas like Darwin and regional WA (where listings are down 32.5% and 16.7% from equivalent period last year) tend to see outsized gains as new buyer interest meets scarce stock.

Source: CoreLogic

Buyer Activity: Improved Affordability Drives Demand

Mortgage Capacity Expands

A 0.25% rate reduction can boost borrowing capacity by $20k–$30k for median-income households, according to RBA modelling. After February’s cut, overall mortgage enquiries jumped 7.2%, and first-home buyer approvals rose 5.4% month-on-month.

First-Home Buyers & Upgraders

- First-Timers: Improved serviceability provides a critical entry window before competition intensifies and prices climb further.

- Upgraders: Existing homeowners can refinance at lower rates and leverage equity toward larger or more centrally located properties.

Read More: Women & Property Investment in Australia: Closing the 40% Wealth Gap

Investor Resurgence

Investors are returning, attracted by lower debt costs and strong rental returns.SQM Research reports gross yields across capitals at 3.73%, the highest since 2019 while investor lending inquiries increased 6.8% post-cut, especially in Hobart (4.4% yield) and Darwin (6.6% yield).

Immediate vs. Medium-Term Impacts

| Indicator | Immediate Effect | Medium-Term Outlook |

| Buyer Confidence | Surge in enquiries & offers | Sustained higher auction clearances |

| Mortgage Approvals | +5-7% in first-home & investor loans | Continued strength if further cuts |

| Property Prices | +0.3-0.5% monthly gains | 3–5% annual growth forecast |

| Auction Clearance Rates | Lift to ~61-63% | Return toward pre-2022 norms (~65%) |

Key Takeaways

- Near-Term Price Rises: Expect 0.3-0.5% monthly increases, especially in undersupplied and high-demand markets.

- Increased Buyer Activity: Mortgage approvals and enquiries will climb, leading to quicker sales and more competitive bidding.

- First-Home Buyers’ Window: Act swiftly to secure entry before rising prices negate affordability gains. With the new scheme, First home buyers can purchase a house with only 5% deposit offering a huge down from 10-20% deposit making it the right time before the property market frenzy.

- Investor Opportunities: Strong yields and lower finance costs make both capital-city and regional markets appealing.

Conclusion

The RBA’s May 2025 rate cut is set to inject fresh life into Australia’s property market driving borrowing capacity, igniting buyer confidence, and lifting dwelling values. Ultimately, timing and preparation will be crucial. As Australia’s property market braces for this next wave of momentum, the advantage will go to those who act decisively, armed with the latest insights and a clear strategy.

With interest rates easing and listings still thin on the ground, savvy buyers and investors have a golden opportunity to get ahead of the pack. Whether you’re eyeing a high-growth regional hub or a tightly held inner-city pad, now’s the time to do your homework and make a move. Don’t get caught on the sidelines — the smart money’s already circling.

This is whereLiviti can be a game-changer. With our property experts and services, we can help you get started on your property investment journey at the best time and place possible.