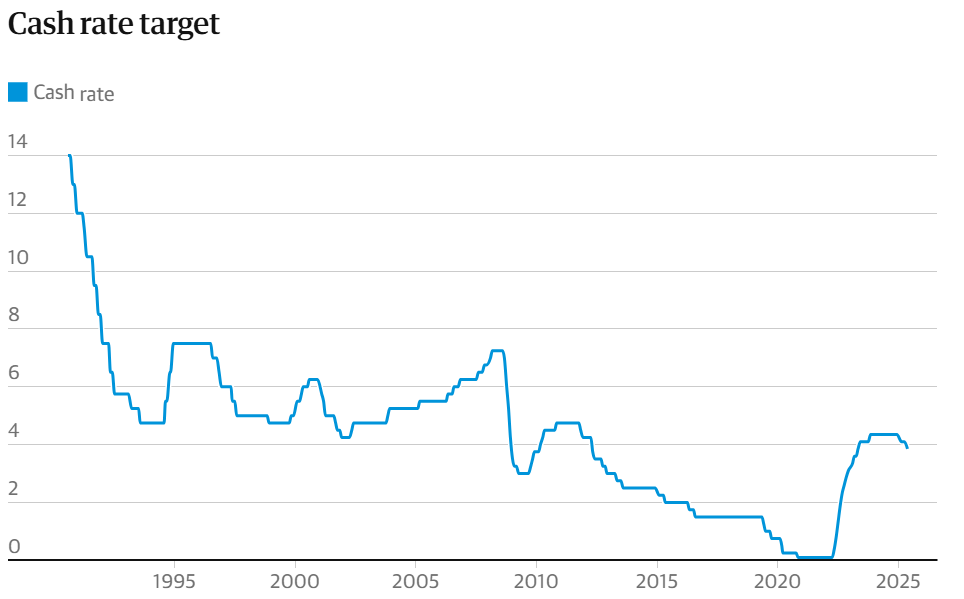

On 20 May 2025, the Reserve Bank of Australia (RBA) delivered its second rate cut of the year, trimming the official cash rate by 25 basis points to 3.85 percent. As Governor Michele Bullock noted,

“Inflation is in the target band and upside risks appear to have diminished as international developments are expected to weigh on the economy.”

This statement underscores the Board’s view that, while domestic price pressures have eased, global uncertainty still warrants accommodative policy.

Source: RBA

Impact on Borrowing Costs and Mortgage Repayments

Lowering the cash rate directly influences the interest rates banks charge each other overnight and, in turn, the variable and fixed mortgage rates offered to borrowers. Analysts estimate that a full 25 bp cut can shave around additional A$110 off monthly repayments on a typical A$750,000 home loan if lenders pass the cut through in full.

Reflecting on the decision, the Board added:

“The board assesses that this move will make monetary policy somewhat less restrictive. It nevertheless remains cautious about the outlook.”

This balance eases pressure on household budgets while guarding against over-tightening meaning many borrowers should see an immediate boost to their disposable income.

Buyer Sentiment and Demand Dynamics

With borrowing costs falling, buyer sentiment typically improves. First-home buyers may find themselves able to stretch into markets that were previously unaffordable, while investors could re-enter after a period of caution. CoreLogic notes that a sustained period of lower rates often spurs both owner-occupier and investor activity, especially in regions where price growth has been muted over the past year.

Based on previous easing cycles, CoreLogic estimates that national dwelling values could rise by around 1.5 percent following a 25 bp rate cut, though outcomes will vary by city and suburb.

Read More: The ALP Government First Home Loan Deposit Scheme: What It Means for First‑Home Buyers in 2025

Short-Term Uplift vs. Medium-Term Price Pressures

In the weeks ahead, expect:

- Auction clearance rates to tick up as buyers re-engage.

- Listing volumes to slowly recover, giving purchasers a broader choice.

- Price gains in undersupplied markets such as parts of Sydney and Melbourne.

However, if the easing cycle continues, markets are pricing in another ~57 bp of cuts by year-end. There’s a risk of overheating in hot suburbs. Prospective buyers should monitor serviceability buffers and avoid overleveraging.

What to Expect Next: Risks and Opportunities

Further rate cuts will depend on:

- Inflation data: Will core measures stay in the 2–3 percent band?

- Wage growth: Strong pay rises could prompt a pause.

- Global developments: Any escalation in trade tensions or geopolitical risks.

Property market participants can seize the current window to secure lower-cost finance, but must stay alert to lender pass-through rates, evolving credit standards, and the possibility that the Board may pause if inflation or wages surprise on the upside.

It’s essential to carefully assess individual borrowing capacity and avoid overextending, especially as some lenders may delay passing on the full benefit of the RBA cash rate cut. Additionally, monitoring economic indicators closely will help buyers and investors anticipate any shifts in monetary policy. Those who stay informed and flexible will be better positioned to capitalise on favourable borrowing conditions while managing risks effectively in a dynamic market environment.

The Australian Market is going to see a surge in prices and with further rate cuts predicted through out the year, the time to invest is now. At Liviti, we will guide clients through every step of their property journey with expert knowledge and practical strategies.

Let’s get started on your property investment journey today. You say Yes and we handle the rest. Book your FREE consultation with us today.