Millennial property investors in Australia are investing in property that has long been considered a lucrative wealth-building strategy, and it appears that they are keenly aware of the benefits it can offer.

In today’s Australian real estate market, millennials are emerging as the frontrunners in property investment. With a growing desire to secure their financial future and build wealth, the millennial generation is actively engaging in property investment like never before.

Lending Landscape: Millennial Property Investors Driving Growth in Property Investment

Recent data from leading financial institutions like CommBank reveals that millennials are not only the most active generation in property investment but they are also displaying a strong inclination towards taking on solo property investments.

According to CommBank’s data, a remarkable 46% of new property investors Australia in 2024 were millennials, born between 1981 and 1996. This signifies a significant shift in the demographic landscape of Australian property investors, with millennials taking the lead in this competitive market.

In contrast, Gen X, born between 1965 and 1980, accounted for 37% of all new investment property purchases during the same period.

Solo Ventures: Millennials Investing Independently

The average age of property investors in Australia is 43 years, which reflects a diverse range of age groups participating in the property market. Additionally, the average loan size for property investments hovers at just over $500,000, indicating a substantial investment commitment from individuals across various demographics.

The surge in millennial property investment comes at a time when investors are driving significant growth in the lending market. They are looking forward to be investors for property investment.

Recent data from the Australian Bureau of Statistics reveals that lending to investors saw a substantial increase of 18.5% over the past year, indicating a strong appetite for property investment in the current economic landscape.

In comparison, lending to first-home buyers recorded a 13.2% rise, while owner-occupiers experienced a modest 3.4% increase in lending activity.

Dr. Michael Baumann, the Executive General Manager of Home Buying at Commonwealth Bank, highlighted the notable trend of millennials opting to venture into property investment independently.

Surprisingly, almost one-third of all millennial investors properties were purchased by investment properties on their own, showcasing a growing trend of self-reliance and financial empowerment among this generation.

Read More: Why Australia’s Wealthiest Prefer Property Investment

Rentvesting: A Popular Strategy Among Millennials

A notable trend among Australians, as highlighted by Dr. Baumann, is the concept of ‘rentvesting.’

Rentvesting involves purchasing property in affordable areas while renting in desired locations. This allows individuals to enter the property market sooner and retain their preferred lifestyle. Rentvesting enables Australians to make strategic property investments in lower-cost regions without compromising their living standards.

Prime Locations: Hotspots for Millennial Property Investment

With capital city home prices remaining high and no signs of decline, rentvesting emerges as a practical alternative to traditional home ownership. It allows individuals to navigate the challenging property market while maintaining their desired lifestyle.

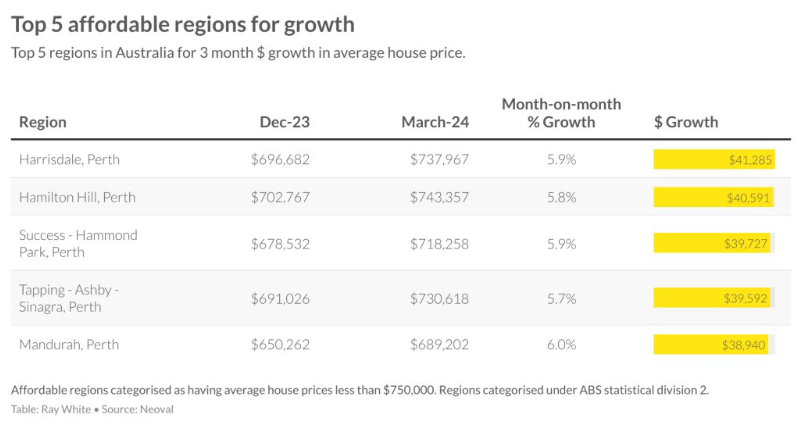

Recent data from Ray White reveals promising opportunities for east-coast Millennials eyeing property investment in Western Australia.

Many in the industry are advocating for rentvesting as a prudent strategy, enabling millennials to invest in more affordable areas while renting in more expensive cities. However, it is advised to take careful consideration of factors like taxes and market uncertainties.

In summary, the shift towards Western Australia presents a new frontier for property investment to millennials and creates a pathway to financial growth amidst soaring urban prices.

Source: Domain

Conclusion

In conclusion, the rise of millennials as prominent players in property investment signifies a dynamic shift in the real estate market.

With a growing emphasis on financial independence and wealth accumulation, millennials actively seek out opportunities to secure their future through strategic property investments.

By embracing innovative approaches and digital tools, millennials are positioning themselves as formidable players in the competitive property market, driving growth, and diversity in investment opportunities.

Frequently Asked Questions (FAQs)

Why are millennial property investors investing in property in 2024?

Millennial property investors are investing in property in 2024 due to a growing desire for financial security and wealth accumulation. With property prices stabilizing in many regions and attractive lending conditions, they see real estate as a stable and lucrative investment. Additionally, advancements in digital tools and access to comprehensive market data empower millennials to make informed investment decisions.

What are the benefits of rentvesting for millennials?

Rentvesting offers millennials the flexibility to live in desirable areas while investing in more affordable regions. This strategy allows them to enter the property market sooner and benefit from capital growth in emerging markets. By renting in preferred locations and owning investment properties elsewhere, millennials can maintain their lifestyle without compromising on their investment goals.

What is the average age of property investors in Australia?

The average age of property investors in Australia is 43 years. This reflects a broad participation across different age groups, with millennials becoming increasingly prominent in the market. The diversity in age indicates that property investment is a viable strategy for wealth building at various stages of life.

What are the prime locations for millennial property investment in 2024?

Prime locations for millennial property investment in 2024 include emerging suburbs and regions with strong growth potential. Areas like Western Australia are gaining attention due to their affordability and development prospects. Additionally, suburbs within a reasonable distance from major cities, offering good infrastructure and amenities, are popular among millennial investors seeking long-term capital growth.

How many property investors are in Australia?

According to recent data from the Australian Taxation Office (ATO), there are over 2 million property investors in Australia. This number has been steadily growing, driven by the increasing popularity of property as a stable investment option.

Can foreign investors buy property in Australia? Yes, foreign investors can buy property in Australia, but there are restrictions. They must obtain approval from the Foreign Investment Review Board (FIRB) and typically can only purchase new dwellings, not existing homes, to encourage new housing development.

How do property investors make money?

Property investors make money through rental income and capital appreciation. By renting out properties, investors receive a steady stream of income, while the property’s value can increase over time, providing a significant return on investment when sold.

How much do property investors make?

The income of property investors varies widely based on location, property type, and market conditions. On average, rental yields in Australia range from 3% to 5%, while capital growth can add further to their returns, making property investment a lucrative option.

How to become a property investor?

To become a property investor, start by researching the market, setting financial goals, and securing financing. It’s essential to choose the right property in a good location, manage the property effectively, and stay informed about market trends and regulations.

How to find property investors?

Finding property investors can be done through networking events, real estate investment groups, and online platforms. Engaging with real estate professionals and attending property investment seminars can also help connect with potential investors.

How to get investors for property development?

To attract investors for property development, create a compelling business plan, highlight potential returns, and provide detailed financial projections. Networking, leveraging professional contacts, and showcasing successful past projects can also be effective strategies.

What do property investors do?

Property investors purchase, manage, and sell properties to generate income and build wealth. They may focus on residential, commercial, or industrial properties and use strategies like renting, flipping, or developing properties to maximize returns.

How to find investors for property development?

Finding investors for property development involves networking, attending industry events, and using online platforms dedicated to real estate investments. Building a strong business case and presenting detailed project plans are key to attracting investors.

How to find investors to buy property?

Investors can be found through real estate investment clubs, online forums, and social media platforms. Building relationships with real estate agents, financial advisors, and attending property auctions can also help in finding potential investors.

How to find private investors for property development?

To find private investors, network within real estate and business communities, use online investment platforms, and seek referrals from industry professionals. Offering attractive investment opportunities and maintaining transparency can attract private investors.

How to get property investors?

Attract property investors by presenting solid investment opportunities, highlighting potential returns, and showcasing successful past projects. Networking, maintaining a professional online presence, and leveraging social media can also be effective.

How to source property for investors?

Sourcing property for investors involves researching market trends, identifying high-growth areas, and finding properties with strong rental yields and capital growth potential. Collaborating with real estate agents and using property listing sites can aid in the process.

What do property investors look for?

Property investors typically look for properties in prime locations with potential for capital growth and high rental yields. They consider factors like market trends, infrastructure developments, and economic indicators to make informed investment decisions.

What is a property investor?

A property investor is an individual or entity that purchases properties to generate income or achieve capital appreciation. They may invest in residential, commercial, or industrial properties and employ various strategies to maximize their returns.

What percentage of rental properties are owned by small investors?

Small investors own a significant portion of rental properties in Australia. According to the ATO, around 70% of rental properties are held by individual investors with one or two properties, highlighting the crucial role of small investors in the rental market.

Where to find investors for property?

Investors can be found through real estate investment groups, online platforms, and networking events. Engaging with professionals in the real estate industry and utilizing social media can also help in connecting with potential investors.

Where to find property investors?

Property investors can be found on online investment platforms, real estate forums, and through networking at industry events. Building a professional network and leveraging contacts within the real estate community can also be effective in finding investors.