Welcome to the fascinating world of property investment, where we’re about to spill the beans on a game-changer – Leverage. This is your ticket to grasping the magic that makes property unique by using leverage in property investments and why banks are practically high-fiving you in this journey to financial freedom.

Chapter 01: Your Step-by-Step Guide to Buying Property in Australia

Chapter 02: Learn Everything You Need On How To Purchase Property In Australia

Chapter 03: Why Investing In Property Is The Way To Create Wealth & Financial Freedom In Australia

Chapter 04: 8 Steps For Investment Property Financing To Purchase Your Dream Property

Chapter 06: Equity Release Strategies You Need To Know To Achieve Financial Freedom Through Property

Chapter 07: Building A Diverse Property Portfolio For Long-term Success

1. The Magic of Leverage

Discovering the Power of Leverage in Property

Property, the superhero of assets, brings in a game-changer – leverage.

In property talk, leverage is like adding borrowed money to your investment mix to crank up the potential returns. It’s using a bit of your own cash to purchase a property that would otherwise be out of your reach.

The goal? Turbocharge those potential profits.

Leveraging in property allows individuals to increase their exposure to real estate assets without breaking the bank. This strategy can involve securing mortgages or loans to fund property acquisitions to enhance the impact of the initial capital invested.

While leverage can be a powerful tool to maximise returns in property investment, it’s crucial to recognise that it also introduces an elevated level of risk. The same mechanism that magnifies potential gains can similarly amplify potential losses. A thorough understanding of the dynamics of leverage in the context of property is essential for making well-informed investment decisions.

Let’s break down how the magic of Leverage can turn a $100,000 investment into an entire $500,000 property, powering your property investment journey.

Unlocking the Math Behind Your Wealth

Now, let’s get cosy with some simple math that unveils the beauty of leverage.

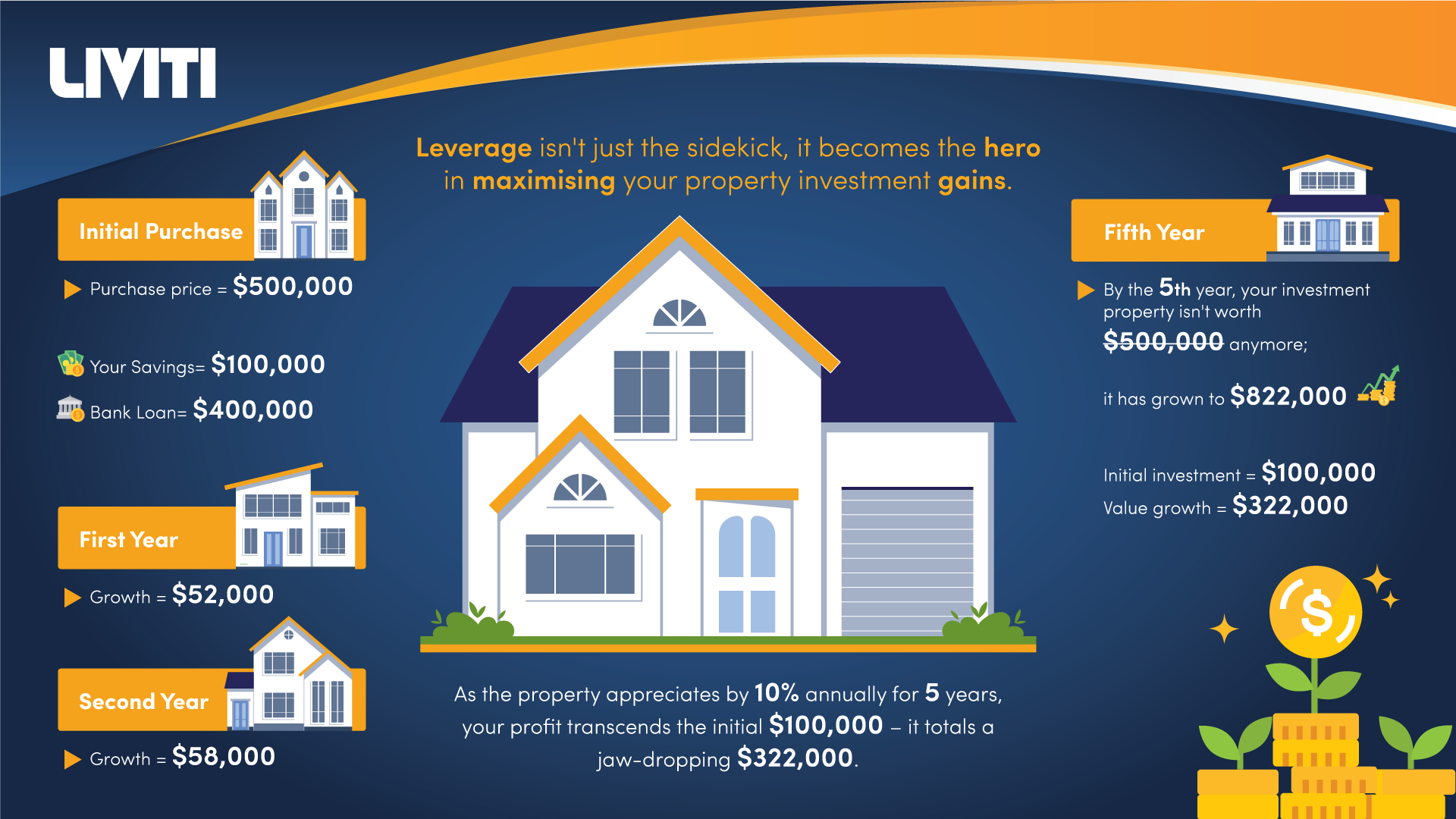

Imagine this: You’re purchasing a $500,000 property with $100,000 of your savings and a $400,000 loan from the bank.

As the property appreciates by 10% annually for 5 years, your profit transcends the initial $100,000 – it totals a jaw-dropping $322,000. Leverage isn’t just the sidekick, it becomes the hero in maximising your property investment gains.

Here’s the breakdown:

- In the first year, you make $52,000.

- In the second year, another $58,000.

- By the 5th year, your investment property isn’t worth $500,000 anymore; it has surged to $822,000.

- Your initial investment of $100,000 has now grown into $322,000 of profit.

2. Why Banks Love Leverage

Now you’re probably wondering, ‘Why are banks so willing to provide borrowed capital for leveraging in property investment? ‘

The answer is pretty straightforward…

Understanding Banks’ Perspective

Banks recognise the potential and strength in property.

Unlike the ups & downs of the stock market, investment properties represent tangible, finite assets that are like a steady ship. They fulfil a fundamental need – the universal desire for a home, personal space, and privacy.

So, when banks see your property plans, they’re jumping on board.

Benefits of Partnering with Banks

Amplifying the Stability

When you leverage borrowed money to invest in property, the benefits extend beyond just the appreciation of the investment property. It’s a dual advantage—profits not only from the property’s value increase but also from the leverage itself. This unique synergy explains why banks are not just willing, but eager to collaborate with you. By leveraging borrowed capital, you are not only enhancing your potential returns but also aligning your interests with those of the banks.

Collaboration for Tangible Results

Banks aren’t just throwing a few dollars into the pot; they’re your partners in crime, turning your property plans from dreams into reality. They become strategic partners in transforming your investment strategy and understand that by supporting your endeavours in property investment, they are fostering a relationship where you both stand to gain. It’s a win-win scenario.

In a nutshell, the banks’ enthusiasm for providing borrowed capital for leveraging in property investment because they see the stability and solid growth potential in real estate.

It’s a symbiotic relationship where your success is not just welcomed but actively supported by financial institutions eager to see your property investment dreams come to fruition.

Conclusion

In conclusion, property investment in Australia stands out as an exceptional venture, powered by the unique kick of leveraging borrowed money. It’s a space where your investment strategy involves harnessing other people’s money to propel your wealth to new heights. And in this pursuit, the banks aren’t just spectators; they’re your partners-in-crime, ready to back your play for financial success.

So, embrace the magic of leveraging borrowed capital and unlock the full potential of property investment – a journey like no other.

Frequently Asked Questions

What is leverage in property investment, and how does it differ from other asset classes?

Leverage in property investment involves using borrowed capital to amplify the potential returns on an investment property. Unlike other asset classes such as stocks or bonds, where investors typically use their own funds, property allows you to use borrowed money to increase your investment exposure.

How does leveraging work in property investment, and what are the potential benefits?

Leveraging in property involves securing a loan, such as a mortgage, to finance a property purchase. The potential benefits are substantial: it magnifies your investment, enabling you to control a more valuable property with a smaller amount of your own money. This can significantly boost potential returns.

Can you provide an example of how leverage amplifies returns in property investment?

Imagine you buy a $500,000 property with $100,000 of your savings and a $400,000 loan. If the property appreciates by 10% annually for 5 years, your profit isn’t limited to your initial $100,000 – it’s a substantial $322,000, showcasing how leverage amplifies returns.

Why do banks favour lending for property investment compared to other types of investments?

Banks favour lending for property investment because real estate is seen as a stable, tangible asset. Unlike stocks that can be volatile, property tends to appreciate over time, making it a safer bet for lenders.

What makes property a preferred asset for leveraging compared to stocks or bonds?

Property’s tangible nature and stability make it a preferred asset for leveraging. The universal demand for homes provides a inherent value that stocks or bonds may lack, making property a more secure investment for both borrowers and lenders.

How does leveraging in property investment contribute to wealth accumulation over time?

Leveraging in property allows investors to control larger assets with borrowed money, potentially leading to greater appreciation and returns. As the property value increases, so does the wealth accumulated, creating a snowball effect over time.

What are some risks associated with leveraging in property investment, and how can investors mitigate them?

Risks include market downturns and interest rate fluctuations. Investors can mitigate risks by conducting thorough market research, having a diverse property portfolio, and ensuring they can handle potential interest rate increases.

Is leverage suitable for all types of property investments, or are there specific criteria to consider?

While leverage can be beneficial, its suitability depends on the individual investor’s risk tolerance and financial situation. It’s essential to consider factors like market conditions, property type, and personal financial goals.

How to use leverage to buy property?

To use leverage to buy property, start by securing financing, typically through a mortgage. Evaluate your financial capacity, interest rates, and loan terms. Conduct thorough property research and consider potential appreciation. Diversify your portfolio and ensure you can manage potential risks associated with leveraging. Consulting with financial professionals like Mortgage Brokers, can provide tailored advice for your specific situation.