Australian house values or dwelling values continued to climb in June by 0.5%, marking a solid 8.0% increase over the financial year 2023-24 according to the latest data from CoreLogic. This translates to a significant $59,000 rise in the median dwelling value, now standing at $794,000 across the nation.

This growth trajectory starkly contrasts the previous financial year, which saw a decline of -2.0% in dwelling values. The market’s recovery has been robust, driven by consistent monthly increases ranging from 0.5% to 0.8% since February.

“The persistent growth comes despite an array of downside risks including high rates, cost of living pressures, affordability challenges and tight credit policy. The housing market resilience comes back to tight supply levels which are keeping upwards pressure on values”, said Tim Lawless, CoreLogic’s research director.

House Value Index

The House Value Index is crucial for understanding the housing market trends. This Australian House Price index, which measures the changes in house values across different regions, has shown a consistent upward trend in most areas.

The house value or home value estimate provided by the CoreLogic House Price Index indicates that Australian homeowners have seen steady increases in their property values, contributing to their overall wealth.

Regional Performance

Image Source: CoreLogic

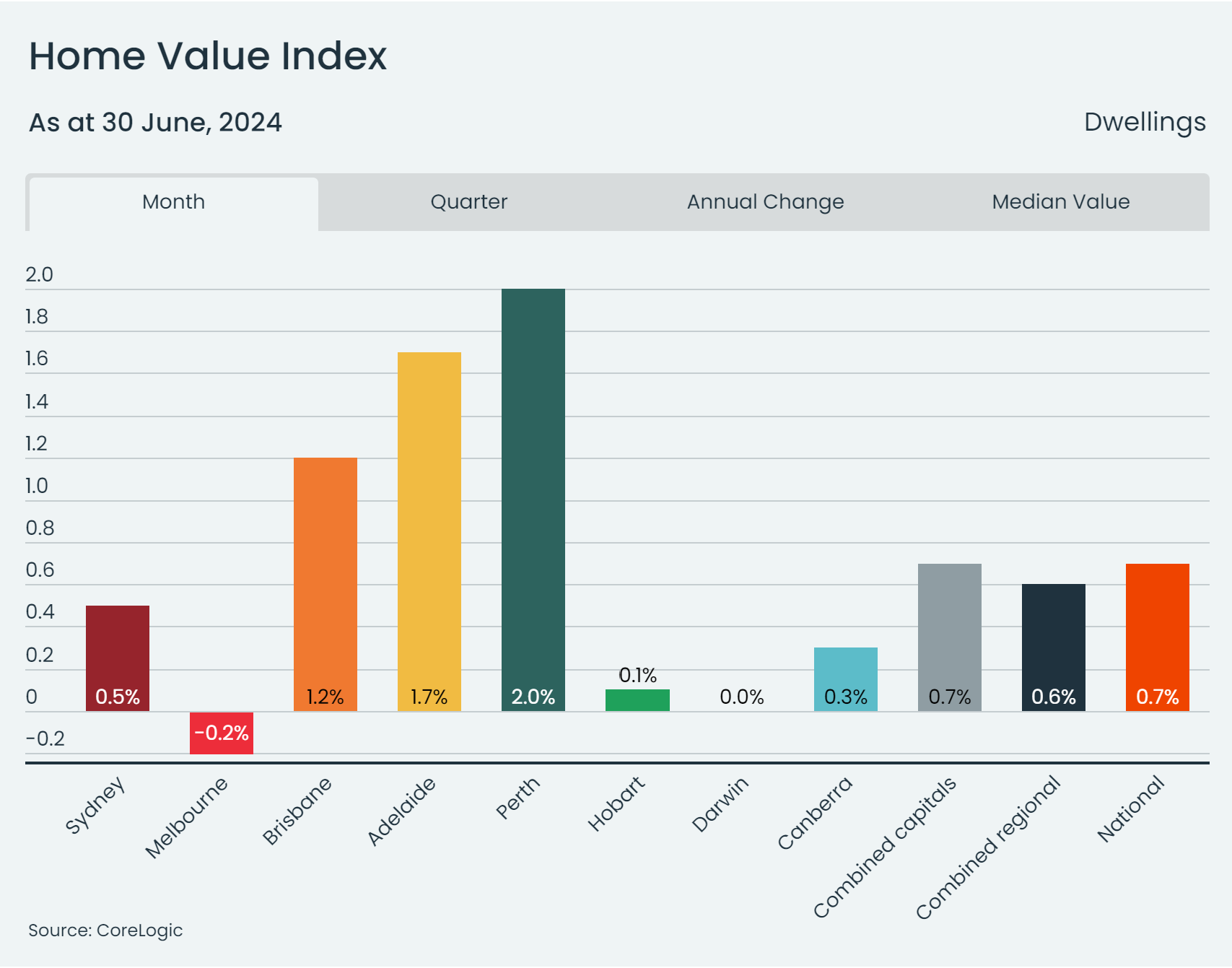

As the city with the highest property prices, Sydney saw a 0.5% increase in its Home Value Index as of June 30, 2024, indicating steady growth in the city’s property values and adding to the overall positive sentiment in the market.

While some regions like Melbourne and Hobart experienced minor declines or subdued growth, mid-sized capital cities such as Perth, Adelaide, and Brisbane have seen remarkable gains.

Perth, for instance, recorded a 2.0% increase in dwelling values in June alone, marking a staggering 23.6% rise over the year.

Similarly, Adelaide and Brisbane have shown increases of 15.4% and 15.8% respectively over the year.

Supply Constraints and Strong Demand

One of the driving factors behind these gains is the strong housing demand despite downside factors. Nationally, the annual home sales were 8.6% higher than a year ago and 4.8% above the previous five-year average.

Perth, in particular, saw the most significant jump in annual sales, with the number of homes sold last year were 29% above average levels (for the 5 year change).

This severe shortage of housing supply in key markets like Perth, Adelaide, and Brisbane, where listings are significantly below historical averages, puts upward pressure on property prices.

Additionally, interstate migration rates remain high, particularly in Western Australia and Queensland, further fueling demand for housing.

Why Invest Now?

Given these market dynamics, now presents a compelling opportunity for property investors looking to capitalise on the Australian property market’s strength:

- Strong Capital Growth: With consistent monthly increases and robust annual gains in the Australian housing market, as highlighted by the house price index, investing in property offers the potential for significant capital gains.

- Wealth Accumulation: Australian homeowners have benefited greatly, with a $59,000 wealth boost from rising home values in FY24 alone.

- Supply Demand Imbalance: The shortage of homes for sale and strong housing demand continue to drive prices higher, making it an opportune time to enter the market.

- Market Resilience: Despite economic uncertainties, the housing market has shown resilience, supported by steady demand and limited supply.

Conclusion

As the Australian property market continues to show signs of strength and recovery, now is an opportune moment for investors to consider property investment.

Whether you’re looking to capitalise on capital growth, rental income, or diversify your investment portfolio, the current market conditions offer promising opportunities.

Stay informed, consult with experts, and consider your investment goals to maximise this favourable market climate.

For further information about property investment, fill out the quick form below to connect with our property experts!