Accessing your home equity loan can be a strategic financial move, offering opportunities to access additional funds, secure new loans on better terms, and optimise your overall financial situation. This comprehensive guide walks you through the key steps and considerations in refinancing your home equity loan.

Understanding Equity

Equity is the financial difference between the current market value of your property and the remaining balance on your home loan. Essentially, it’s the ownership stake you’ve built over time by diligently making loan repayments.

Equity accrues through two primary methods:

1. Loan Repayments: Consistently making payments on your loan helps minimise your outstanding balance, contributing to the growth of your equity.

2. Property Value Appreciation: If the value of your home renovations or property increases over time, it adds to your home’s equity amount.

How to Calculate Your Home Equity and Accessible Equity

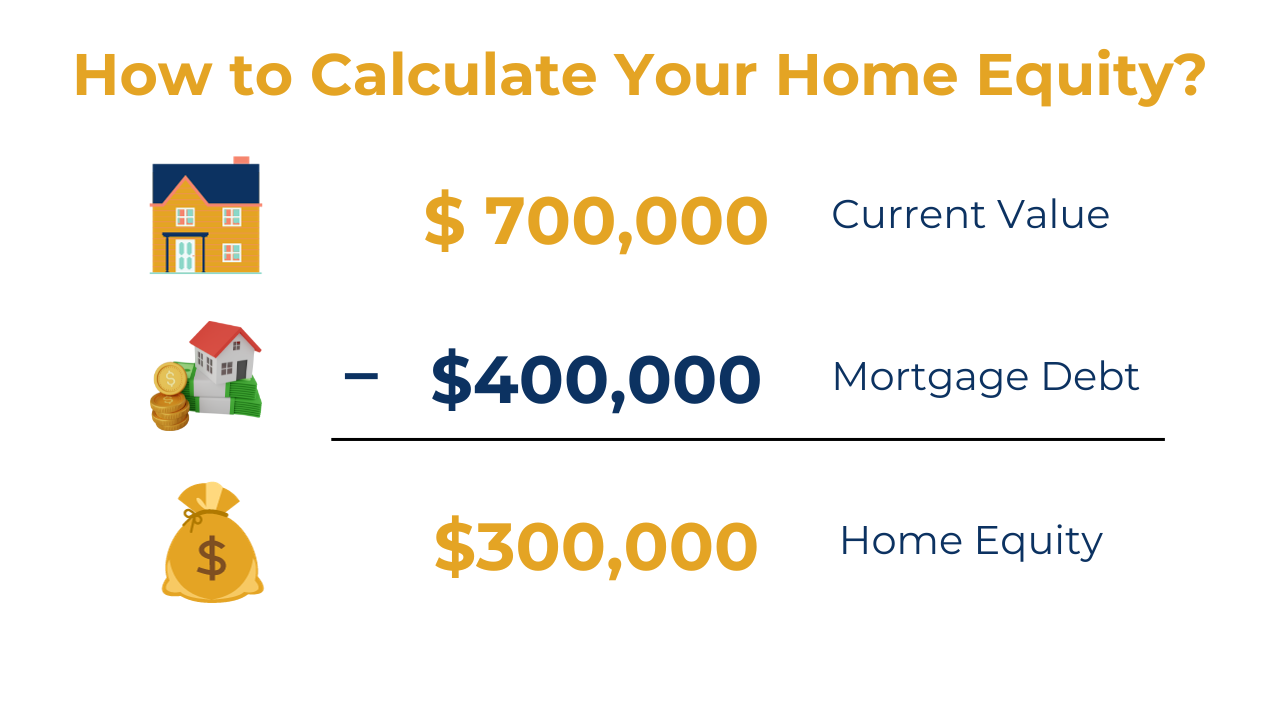

Calculating your equity involves a straightforward equation:

For instance, if your property is valued at $700,000, and your outstanding loan balance is $400,000, your equity would amount to $300,000.

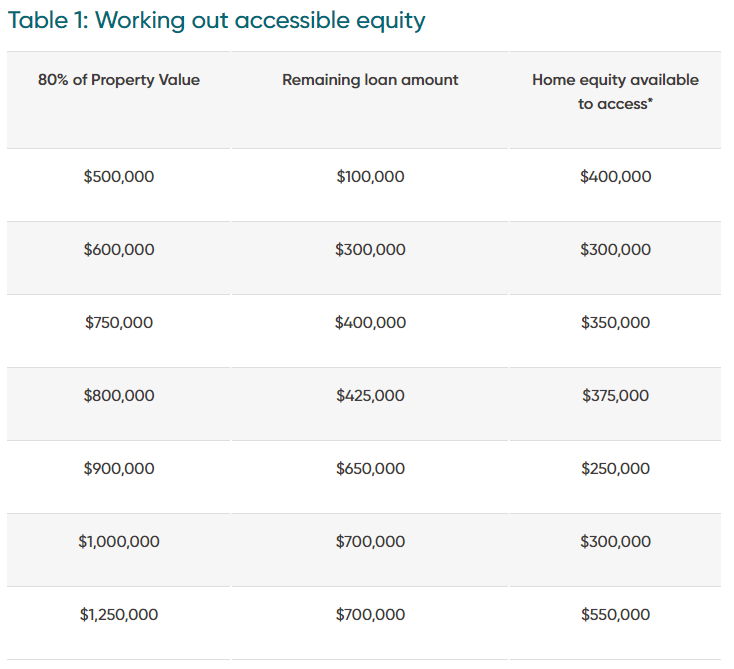

Determine the financial requirements for your plans. It’s essential to consider whether accessing the full available equity is necessary or feasible, considering your servicing capability.

Your ability to manage additional repayments based on your income and expenses is a crucial factor.

For instance, if your property has $150,000 in equity, but your budget allows for only $50,000 in additional repayments, it’s practical to proceed with unlocking the realistic amount rather than the full $150,000 available.

*Home equity available to access calculated using 80% of total property value – remaining loan amount

Source: Mortgage Choice

There is a Home Equity Calculator available that can help you work out how much usable equity you may have and the potential repayments on your new home.

What is a Home Equity Loan?

In financial terms, a home equity loan is a broad category encompassing various loan types that enable you to borrow against your property’s equity.

This category includes a line of credit loans, home loan top-ups, renovation loans, and seniors’ equity loans. Another option is refinancing your current home loan to access funds. The array of choices demonstrates the flexibility available for leveraging your home’s equity to access cash now.

Utilising Equity to Buy Investment Property

Equity is a powerful tool for property investors—it helps them grow their property portfolio faster. Here’s how: many investors use the equity (value) in their current property to buy more properties.

As these properties go up in value, investors can buy even more. It’s like a snowball effect.

Over time, if you keep doing this and add more properties to your collection, something cool happens: when the property market goes up, your property wealth and usable equity also go up.

It’s a smart way to both build equity and manage many properties, but it also means your success depends on how the property market is doing.

How much equity do you need to buy another home?

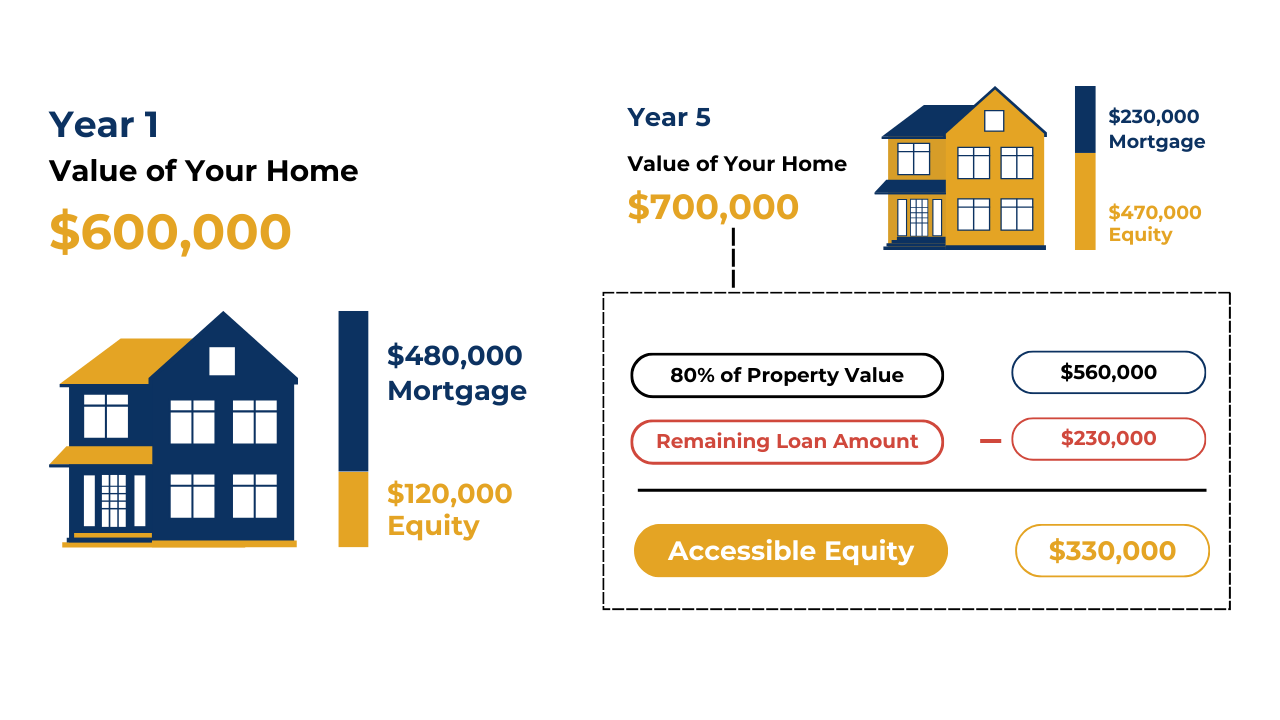

Typically, lenders permit borrowing up to 80% of the property’s equity, deducting outstanding debt, to borrow more equity again for a second property purchase. Consider Sophie, who initially buys a $600,000 property with a $120,000 deposit and a $480,000 home loan, resulting in $120,000 equity.

Over a few years, she pays $250,000 off the loan, leaving $230,000 owing, and the property’s value rises to $700,000. Now, her equity is $470,000.

Wanting to use some of this equity as a deposit for a new property, she calculates her 80% Loan-to-Value Ratio (LVR) based on the property’s value ($700,000), and the loan amount, which is $560,000. Deducting her $230,000 debt, her available equity stands at $330,000, even though her total equity is $470,000.

Things You Need To Consider Before Refinancing

When looking to refinance and tap into existing equity, obtaining an up-to-date property valuation is crucial.

Lenders use this valuation to determine your Loan-to-Value Ratio (LVR), impacting interest rates and the amount of equity available for borrowing. Different lenders may have lending criteria and use different valuers, so selecting the right one is vital.

When considering using equity to purchase a second property, it’s crucial to be aware of potential pitfalls:

- Financial Commitment Risks: Refinancing to access equity involves substantial financial commitment and is not without risks. Managing two home loans instead of one, especially if using equity for a second house deposit, requires carefully evaluating your cash flow to ensure sustainability.

- Extended Debt Repayment: Refinancing your current home to access equity extends the repayment period and increases the debt on your existing home loan. This means you’ll be paying off the loan for a more extended period and incurring higher interest costs over its lifespan.

- Portfolio Diversification Impact: Consider the impact of property investment on portfolio diversification. Concentrating most of your wealth in the property market may leave you vulnerable to market conditions, emphasising the importance of maintaining a diversified portfolio that includes cash, shares, and property.

- Market Sensitivity: Your wealth becomes sensitive to property market fluctuations. If there is a widespread dip in the property market, it could have a corresponding negative effect on your overall wealth.

Before utilising equity for a second property, thoroughly considering these factors and other investments is essential to make informed and prudent financial decisions. It’s advisable to consult with a mortgage broker for personalised advice on your home loan refinance.

5 Steps to Refinance Your Home Equity

Step 1: Identify Your Refinancing Goals

Understand why you’re refinancing, whether for a better interest rate, lower monthly payments, or accessing equity. This clarity will guide your choice of a suitable home loan product.

Step 2: Understand Refinancing Costs

Be aware of fees like mortgage discharge, loan application, valuation, and ongoing lender fees. Consider whether the potential benefits of refinancing outweigh these costs.

Step 3: Calculate Your Equity

Determine your property’s equity by subtracting the mortgage balance from its value. Ensure you have at least 5% equity, with 20% being ideal to avoid additional insurance fees.

Step 4: Gather Necessary Documents

Prepare home loan statements, council rates notices, bank statements, credit card bills, payslips, and IDs. Having these ready streamlines the application process.

Step 5: Consult a Mortgage Broker and Apply

Speak with a mortgage broker to explore refinancing options based on your needs. They can guide you through the application process, help with paperwork, and provide insights on what lenders offer down and cashback offers. Once you’ve chosen a lender, submit your application and prepare for the appraisal process.

#Refinance Process Duration and Tips:

A standard refinance process typically takes up to a month, depending on the lender’s turnaround time and application complexity. Timely monthly repayments made, monitoring your credit file, and calculating comparative savings are crucial to what most lenders consider during the refinancing journey.

Take the next step – speak with our experts now!

In conclusion, navigating the journey of refinancing your home equity loan requires careful consideration and strategic planning.

By understanding your financial goals, weighing the costs and benefits, and collaborating with experienced professionals like mortgage brokers, you can make informed decisions that align with your objectives.

Remember, each step in the refinancing process plays a crucial role, from assessing your equity and calculating costs to gathering necessary documents and consulting with lenders.

As you embark on this financial venture, empower yourself with knowledge, stay updated on market trends, and seek guidance to ensure that your refinancing experience leads to greater financial stability and the achievement of your homeownership aspirations.

FAQs

Can I refinance a home equity loan?

Yes, it is possible to refinance a home equity loan. Refinancing allows you to replace your existing loan with a new one, potentially securing a new car on better terms or accessing additional funds.

Can you use your home equity to refinance?

Yes, you can use your home equity to refinance. Refinancing using home equity involves taking out a new loan that is secured by the equity in your home. This can be done for various reasons, such as securing a lower interest rate, changing the terms of your loan, or accessing additional funds for purposes like home improvements or debt consolidation. The amount of equity you have in your home is crucial in determining how much you can borrow through the refinancing process.

What is the difference between a refinance and a home equity loan?

The main difference between a refinance and a home equity loan is that a refinance involves replacing your existing mortgage with a new one, potentially for better terms or additional funds, while a home equity loan is a separate loan that allows you to borrow against the equity in your home for specific purposes. Refinancing affects your entire mortgage, while a home equity loan is an additional loan on top of your current mortgage.

Which is better, a refinance or a home equity loan?

The better option between a refinance and a home equity loan depends on your specific needs and financial goals. If you aim to obtain better overall mortgage terms or access additional funds while potentially saving on interest, a refinance may be suitable. On the other hand, if you have a specific purpose, like home improvements or debt consolidation and prefer a lump sum amount, a home equity loan might be more appropriate. It’s advisable to consult with a financial advisor to determine the best choice for your individual circumstances.

How do I calculate the costs associated with accessing equity?

The costs for accessing equity depend on the chosen financial product and the desired equity amount. If you opt to access more than 80 percent of your property’s value, you may incur expenses like Lenders’ Mortgage Insurance (LMI). Switching to another lender can also involve costs such as fees for breaking from a fixed-rate product, a new loan application fee, or government fees. It’s essential to be aware of these potential fees when evaluating your options for equity access.